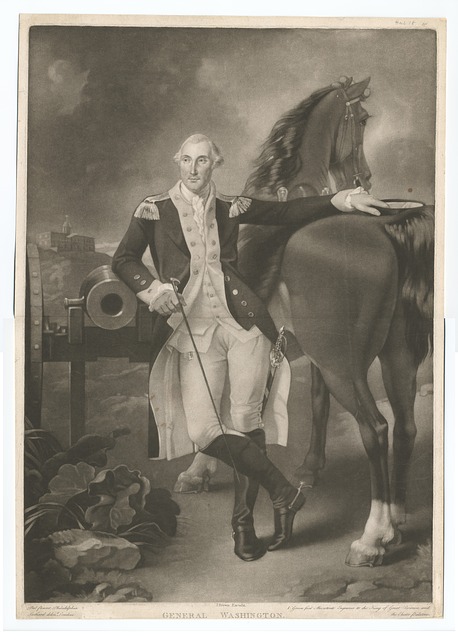

George Washington gave some great advice that we can still use today, in his farewell address of 1776:

George Washington gave some great advice that we can still use today, in his farewell address of 1776:“Don’t blow the tax payer’s cash on tanks, don’t elect the same guy more than twice and don’t let the nations politics devolve into partisan bickering.”

Well let me tell you that the year has gotten off to a quick start with optimism and resolve, not just here at CDC but seemingly through the market place and the economy. I used to refer to the economy/market being like pushing a ball up a hill now the ball is rolling down the hill.

Optimism is based on several factors:

- The continued strong economy, which should be boosted by tax reform that was extremely kind to the president’s profession.

- Property fundamentals that generally fall between positive and robust.

- Continued strong capital flows that enhances liquidity and support record-high property values, while low acquisition yields seem immune from the slow rise in long-term interest rates.

- Perhaps most important, the uncharacteristic restraint exercised by the market this deep into a recovery.

The market’s discipline is the foundation for those who dare to wonder if today’s cycle is different from those in the past. Cycles don’t normally last this long, and typically after a few years with good returns the market starts to overheat. Construction is overextended, capital flows forces equity players to chase ever-riskier deals that rely on unrealistic income assumptions, and hot competition forces banks to be more aggressive in lending, increasing leverage and cutting coupons. As we start 2018, however, the red flags normally associated with the late cycle are the exception rather than the rule.

The real estate investment sector has been very robust the last five years with billions of capital invested in this sector. The new tax bill and pro-growth policies in Washington will produce higher GDP growth of 3.5% – 4%+ and with it higher interest rates. Net lease assets are the most susceptible to higher interest rates and interest rate risk. Asinterest rates increase, cap rates will follow, and the values will suffer declines in value.

There are 15 risks inherent in investing in CRE as follows:

- Cash Flow Risk – volatility in the property’s net operating income or cash flow.

- Property Value Risk – a reduction in a property’s value.

- Tenant Risk – loss or bankruptcy of a major tenant.

- Market Risk – negative changes in the local real estate market or metropolitan statistical area.

- Economic Risk – negative changes in the macro economy.

- Interest Rate Risk – an increase in interest rates.

- Inflation Risk – an increase in inflation.

- Leasing Risk – inability to lease vacant space or a drop, in lease rates.

- Management Risk – poor management policy and operations.

- Ownership Risk – loss of critical personnel of owner or sponsor.

- Legal, Tax and Title Risk – adverse legal issues and claims on title.

- Construction Risk – development delays, cessation of construction, financial distress.

- Entitlement Risk – inability or delay in obtaining project entitlements.

- Liquidity Risk – inability to sell the property or convert equity value into cash.

- Refinancing Risk – inability to refinance the property.

All investors that own CRE should perform a detailed and systematic review of the above risks and their potential effect on their assets.

The Federal Reserve could have a big impact in 2018. Jerome Powell, the next Fed chairman is expected to continue on the path of gradually tightening monetary policy. It is hard to determine the exact impact of rising rates but it is pretty safe to assume that as rates rise so will cap rates.

So, you might ask how this might affect you? Let me give you a simple example;

Today you own a property that has;

$55,000 a year net income and 5.5% CAP today gives you;

$1,000,000 in property value.

CAP rates move up by .5% with $55,000 a year net income

6% CAP tomorrow gives you;

$916,000 in property value.

CAP rates move up by 1% with $55,000 a year income.

6.5% CAP tomorrow gives you;

$846,000 in property value.

Now assume you bought that $1 million with 30% down and 70% loan and CAP rates rose by 1% (5.5% to 6.5%). Your $300K of equity just got cut in half ($1,000,000 – $846,000 = $154,000. Leaving you $146,000 of equity). So, a 1%-point rise in CAP rate wipes out 50% of your equity.

Solution?

Raise rent. In the example above if we move the rent up by $10,000 a year and CAP rates moved up to 6.5% you would still have a property worth $1,000,000. So…rent must rise to keep your value whole in a rising CAP rate environment.

Here are a few of my random observations for the month;

- Home equity hits all time high – the home ATM is back!

- Health Care is moving from being about coverage to being about affordability. CVS buys Aetna. Heel.com goes public.

- Wal-Mart Stores drops the word “stores” from their name. Bring it on Amazon.

- In 2015, Wal-Mart paid 6.4 billion in taxes and Amazon paid $1.6 billion (but had more sales). Watch out Mr. Bezos, the tax man is coming.

- Bitcoin is a window into the exuberance there is for yield and what an overheated market can look like . I thought a telephone number and social security number were unique numbers, I wouldn’t think to pay $18,000 for one!

If you like these “glimpses” you might also enjoy this List of Niche Real Estate Concepts by Economist Gary London that may be here today and gone tomorrow.

So as we at CDC scurry abut trying to battle the forces of evil and get deals done, I thought you might enjoy the modern day Noah story…

It is the year 2018, and Noah lives in the United States. The Lord speaks to Noah and says: “In one year I am going to make it rain and cover the whole earth with water, until all is destroyed. But I want you to save the righteous people and two of every kind of living thing on the earth. Therefore, I am commanding you to build an Ark.”

In a flash of lightning, God delivered the specifications for an Ark. Fearful and trembling, Noah took the plans and agreed to build the Ark.

“Remember,” said the Lord, “You must complete the Ark and bring everything aboard in one year.” Exactly one year later, a fierce storm cloud covered the earth and all the seas of the earth went into a tumult. The Lord saw Noah sitting in his front yard weeping.

“Noah.” He shouted, “Where is the Ark?”- “Lord please forgive me!” cried Noah. “I did my best but there were big problems. First, I had to get a permit for construction and your plans did not comply with the building codes. I had to hire a civil engineer because I can’t build the Ark without filing an environmental impact statement on your proposed flood, over the entire Earth.

They didn’t take very kindly to the Idea that they had no Jurisdiction over the conduct of the Creator of the universe.

Then the Army Corps of Engineer demanded a map of the proposed new flood plain. I sent them a globe. Right now, I am trying to resolve a complaint filed both with the ACLU and the Equal Employment Opportunity Commission that I am practicing discrimination by not taking godless, unbelieving people aboard! The IRS has seized all my assets, claiming that I’m building the Ark in preparation to flee the country, to avoid paying taxes. I Just got a notice from this state that I owe some kind of user tax and failed to register the Ark as a recreational water craft. Finally, the ACLU got the courts to issue an injunction against further construction of the Ark, saying that since God is flooding the earth, it is a religious event and therefore unconstitutional.