“If God had wanted us to vote, he would have given us candidates.”

– Jay Leno

As we approach tax day, I cringe both at the amount of taxes we pay and our bloated economy that can’t seem to get out of its way. A few years back we did a deal with Congressman Hunter’s office and I saved this email because it still makes me chuckle to this day.

Nancy;

Thank you again for all of your help yesterday. I am asking Rhonda, our office manager, to send you a copy of what our standard gov lease looks like. We will have to confess regarding our current financial situation is that we are $16.3 trillion in debt, but we are working on raising everyone’s taxes to pay for it. But truthfully, we think that this will be a good fit and Rhonda will work with you regarding House of Reps requirements for the lease,

Thanks again,

Rick

District Chief of Staff

Congressman Duncan Hunter

In a rare case of repealing bad law, the State repealed AB-1103, effective January 1, 2016. If you remember I wrote about this law and the requirement to report all of the energy use of your commercial property. Supposedly, they are working on a replacement law to take effect next year. I can hardly wait (but at least no energy disclosure reports this year!).

Another article that I have saved for some time but thought was appropriate in this Tax Day month and election year filled with rhetoric. This is a brief history of commercial real estate by CRE blogger Chris Clark.

“In no other part of the civilized world is land made such an article of commerce and of such incessant circulation.” James Kent on American land use in “Commentaries on American Law 438” published in 1830.

Land wasn’t always an article of commerce as described by Kent. For centuries across Europe, land was an entity whose conveyance and use was governed by common laws concerned with the order of inheritance, alienation and protection from creditors. As a British possession, the American Colonies followed suit.

But the British Debt Recovery Act of 1732 altered this substantially, if not inadvertently, by allowing for the treatment of real property to be the same as chattel/personal property. Essentially, this gave debtors the right to seize not only personal property but land to recover costs. The British saw this solely as an additional means of debt repayment. But in the Colonies, where land was abundant, it was seen as an opportunity to use land as a substitute for money, i.e., an article of commerce.

While there was plenty of handshake agreements, lawyers were eventually the choice of sellers and buyers to record or transfer property title. The agent role evolved in order to find willing buyers for willing sellers. (To this day, real estate agents cannot perform the functions of a lawyer in real property transactions.)

Early real estate agents tended to be the people in town who knew everything and everyone. A fountain of local information they were paid in favors or fees to bring parties together. Unorganized and often acting independently, they could also be unscrupulous in their dealings.

Around the turn of the 20th century, the real estate industry of today emerged when the National Association of Real Estate Exchanges (1908 – now known as NAR) and real estate brokerage firms such as Cushman & Wakefield (1917) were born. Affiliation with these organizations inferred a higher level of ethics and service by their agents or members. Vouching for the honesty of their agents, brokerages and professional groups like these were meant to separate the wheat from the chaff.

By the 1930’s most state laws were written or appended to require that anyone who assisted in the transfer of real estate was licensed or registered with the state. The title insurance industry quickly followed in order to protect buyers and ensure more accurate legal recordings including the encumbrances, liens, restrictions, etc… that could be attached to land.

One of those liens – loans specific to purchase of real property (mortgages) – became more commonplace. Turning the British Debt Relief Act on its head, land was not only an instrument for debt repayment but a way to incur debt itself.

Extensive relationships and local knowledge have for years been the core services that real estate agents provide. Those services have been expanded to include consultation, marketing and information services all in the pursuit of connecting buyers and sellers. Additionally, numerous areas of specialization have evolved due to diversity of product, increased competition and client demand. It is these individuals who contribute to a world-wide industry handling assets in the trillions and accounting for over 50 percent of developed economies’ net worth.

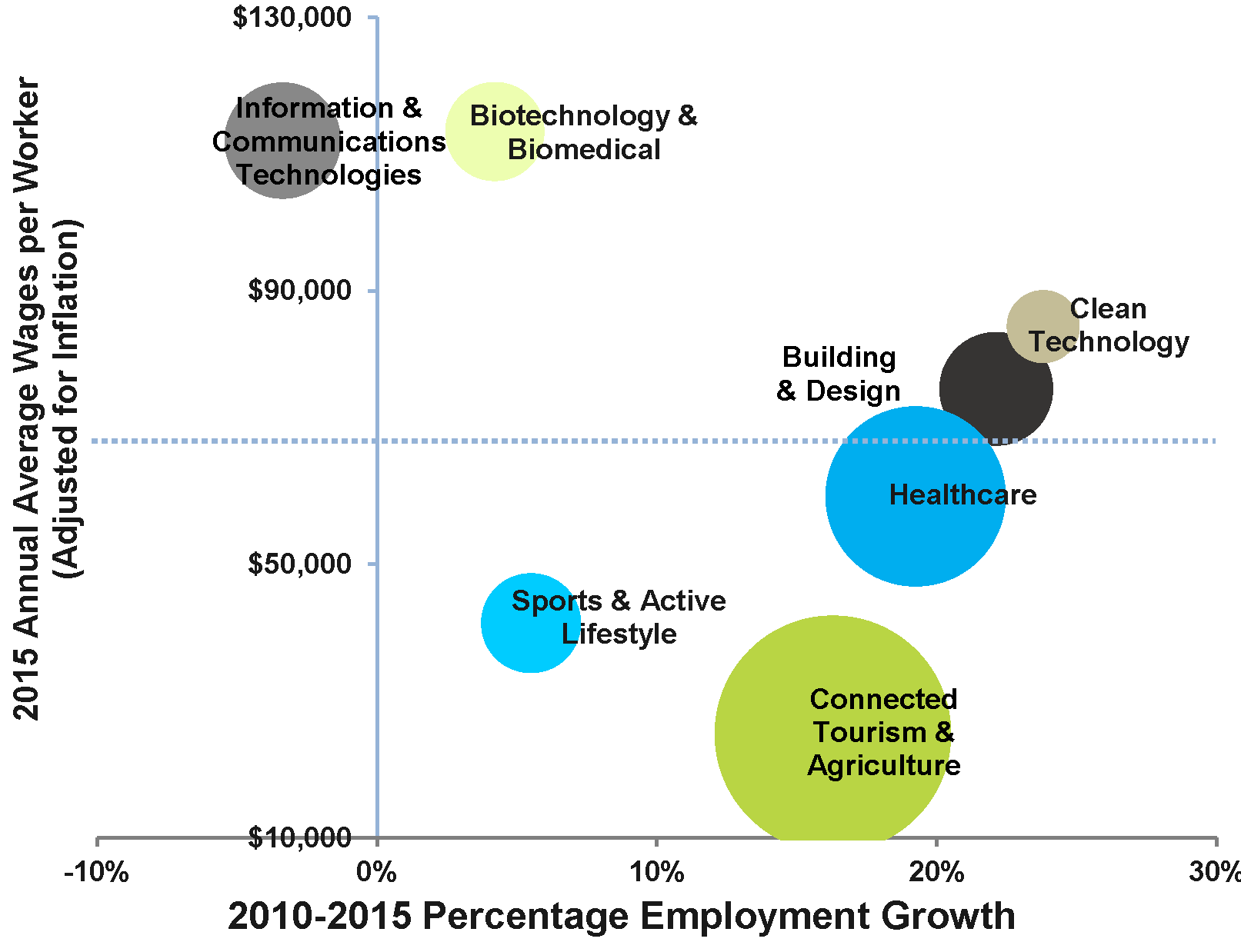

Since a picture is worth a 1000 words I thought I would share this chart of the employment growth in North County over the last five years. This is how we have gone from 7.8% to 4.4% unemployment.

So whether you think there are too many real estate agents, or too many attorneys, just remember there are more IRS agents than there are FBI agents. Heck, I’m proud to be paying taxes in the United States but I could be just as proud for half the money! Hope you enjoy the story…

Regards,

Don Zech

A New Orleans lawyer sought an FHA loan for a client. He was told the loan would be granted, if he could prove satisfactory title to a parcel of property being offered as collateral. The title to the property dated back to 1803, which took the lawyer three months to track down.

After sending the information to the FHA, he received the following reply…

(Actual Letter)

“Upon review of your letter adjoining your client’s loan application, we note that the request is supported by an Abstract of Title. While we compliment the able manner in which you have prepared and presented the application, we must point out that you have only cleared title to the proposed collateral property back to 1803. Before final approval can be accorded, it will be necessary to clear the title back to its origin.”

Annoyed, the lawyer responded as follows:

(Actual Letter)

“Your letter regarding title in Case No. 189156 has been received. I note that you wish to have title extended further than the 194 years covered by the present application. I was unaware that any educated person in this country, particularly those working in the property area, would not know that Louisiana was purchased, by the U.S. from France in 1803, the year of origin identified in our application.

For the edification of uninformed FHA bureaucrats, the title to the land prior to U.S. ownership was obtained from France, which had acquired it by Right of Conquest from Spain. The land came into the possession of Spain by Right of Discovery made in the year 1492 by a sea captain named Christopher Columbus, who had been granted the privilege of seeking a new route to India, was from the Spanish monarch, Isabella.

The good queen, Isabella, being a pious woman and almost as careful about titles as the FHA, took the precaution of securing the blessing of the Pope before she sold her jewels to finance Columbus’ expedition. Now the Pope, as I’m sure you may know, is the emissary of Jesus Christ, the Son of God, and God, it is commonly accepted, created this world. Therefore, I believe it is safe to presume that God also made that part of the world called Louisiana.

God therefore, would be the owner of origin and His origins date back to before the beginning of time, the world as we know it AND the FHA. I hope you find God’s original claim to be satisfactory. Now, may we have our damn loan?”

(The loan was approved.)