![]() If you asked one hundred people on the street if they understand how a refrigerator works, most would respond, yes, they do. But ask them to then produce a detailed, step-by-step explanation of how exactly a refrigerator works and you would likely hear silence or stammering. This powerful but inaccurate feeling of knowing is what Leonid Rozenblit and Frank Keil in 2002 termed, the illusion of explanatory depth (IOED), stating, “Most people feel they understand the world with far greater detail, coherence, and depth than they really do.”

If you asked one hundred people on the street if they understand how a refrigerator works, most would respond, yes, they do. But ask them to then produce a detailed, step-by-step explanation of how exactly a refrigerator works and you would likely hear silence or stammering. This powerful but inaccurate feeling of knowing is what Leonid Rozenblit and Frank Keil in 2002 termed, the illusion of explanatory depth (IOED), stating, “Most people feel they understand the world with far greater detail, coherence, and depth than they really do.”

The economy – with full employment and sky-high stock markets – is screaming for an interest rate rise. But the U.S. Fed and the ECB have signaled they’re going to cut instead. Why are we living in a Bizarro World where an overheating economy generates low inflation, and central banks shovel ever more cash into an on-fire market? U.S. Rep. Alexandria Ocasio-Cortez touched on the issue in a recent hearing: “Unemployment has fallen three full points since 2014 but inflation is no higher today than it was five years ago.” Could it be that we have solved inflation? Is it possible that macro deflationary forces are more powerful than central bank monetary forces? In other words, tech is increasing productivity faster than inflation. The problem is that our government needs inflation so it can pay back its ballooning debt with cheaper dollars. If not we could end up stuck in the mud for the next decade as Japan has been. The next issue is whether governments (infrastructure) and investors (capital and real estate) will be willing to take advantage of the extra fiscal spending space (lower rates) this historic opportunity will likely present.

[DISCLAIMER: The following is not a political statement it is simply an economic observation.]

The U.S. has reached a decade-long economic expansion, the longest in the country’s history, but real estate executives say the “end-of-cycle economy” is one of the top concerns facing the industry. I will tell you what has me concerned for our economy and real estate values; Healthcare. Although I am for everyone having the right to healthcare, the catchphrase of “Medicare for all” is an IOED as stated above. You see, Medicare only pays .87¢ on every dollar a hospital spends. That .13¢ is made up by those of us with private insurance paying $1.13 for our services. Under Medicare for all, hospitals will need to cut about 1.5 million clinical and administrative jobs (remember for every hard employed job it creates seven service-related jobs, so now we’re talking about 10 million jobs at risk). Next, are the jobs in the health insurance industry, that’s about another million. Then the pension plans and IRA’s invested in health insurance companies like Aetna, Cigna and United Health Care. These are billions of dollars of retirement dollars dissolving. Then, of course, there are the Hospitals, Medical Clinics, and offices all of which lease lots and lots of real estate. So what is the solution (first I wish Steve Jobs were still alive!)? Like inflation in our economy, tech is the only way I see out. It creates new jobs and allows existing infrastructure to adapt. So lick your cell phone screen and go see your neighborhood minute-clinic or order an Uber doctor from heal.com (we did and it was amazing!).

Speaking of technology, Uber Eats delivered it’s first McDonald’s food by drone in San Diego! Wow, like answered prayers, “Burger and fries were delivered from the heavens!”

Well, whether it is heaven-sent or not, a potential rate cut by the Fed will be a boon for commercial real estate. First off, lower rates make for higher cash flow and higher values. The reason for the rate cuts is stated as to “spur more inflation” which is also good for real estate values. Seems like a win-win to me.

There is nothing wrong with selling and paying taxes but if you don’t want to pay taxes consider doing an exchange. We get questions all of the time regarding exchanges. Here are the top 10;

Top Ten 1031 Exchange Questions

- Like-Kind means I must exchange the same type of property, such as an apartment building for an apartment building. All real property is like-kind to other real property. For example, you can trade an apartment building for an office building.

- My attorney can handle this for me. Not if your attorney has provided you any non-exchange related legal services within the two-year period prior to the exchange.

- I must “swap” my property with another investor. No. A 101 exchange allows you to sell your relinquished property and purchase replacement property from a third party.

- 1031 Exchanges are too complicated. They don’t have to be. N experienced commercial real estate broker (CDC Commercial Inc), Qualified Intermediary and your tax and/or legal advisors will work with you to make sure the process is as seamless as possible.

- The sale and purchase must take place simultaneously. No. The taxpayer has 45 days to identify the new replacement property and 180 days to close.

- I just need to file a form with the IRS with my tax return and “rollover” the proceeds into a new investment. No. A valid exchange requires much more than just reporting the transaction on Form 8824. One of the biggest traps, when not structured properly, is the taxpayer having actual or constructive rights to the exchange proceeds and triggering a taxable event.

- 1031 Exchanges can also be used on personal property. No. 1031 Exchanges are only for real property.

- All of the funds from the sale of the relinquished property must be reinvested. No. A taxpayer can choose to withhold funds or receive other property in an exchange, but it is considered boot and will be subject to federal and state taxes.

- 1031 Exchanges are just for big investors. No. Anyone owning investment property with a market value greater than it’s adjusted basis should consider a 1031 exchange.

- I must hold the property longer than a year before exchanging it. The 1031 regulations do not list a time requirement on how long you must hold property, but it does say that property must be “held for productive use in a trade or business or for investment”.

And now from the other corner of our office, here are Nick’s numbers for the month;

Nick’s Numbers

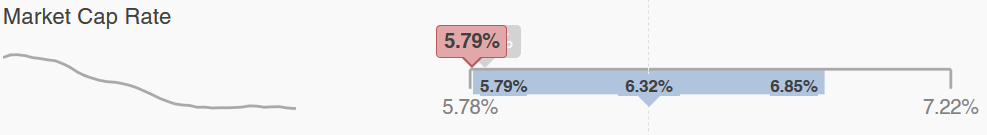

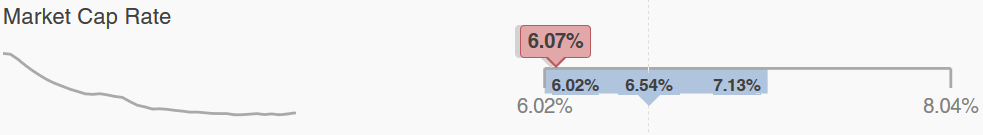

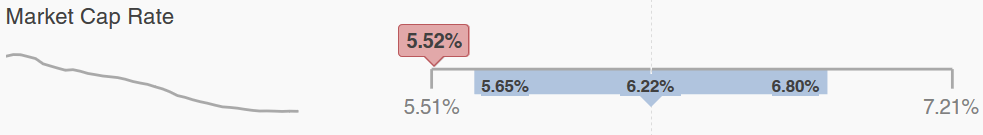

San Diego County Market Cap Rates (Range, Average and Current):

Retail

Office

Industrial

Please give me a call or email me if you would like more in-depth info on Escondido or other San Diego and North County sub-markets (Nick Zech, 858-232-2100, nzech@cdccommercial.com).

Just out – San Diego’s unemployment rate ticked up to 3.3% in June which is an increase from the 10 year low in May of 2.7%. With that, I hope everyone is enjoying their summer and the fireworks in Washington. Stay healthy and be thankful for answered prayers.

Hope you enjoy the story…

Prayers do get answered…

A woman received a call that her daughter was sick.

She stopped by the pharmacy to get medication, got back to her car and found that she had locked her keys inside.

The woman found an old rusty coat hanger left on the ground.

She looked at it and said, “I don’t know how to use this.”

She bowed her head and asked God to send her HElP.

Within 5 minutes a beat-up old motorcycle pulled up. The driver was a bearded man wearing an old biker skull rag. The man got off of his cycle and asked if he could help.

She said, “Yes, my daughter is sick. I’ve locked my keys in my car. I must get home. Please, can you use this hanger to unlock my car?”

He said “Sure.” He walked over to the car, and in less than a minute the car was open.

She hugged the man and through tears said “Thank You SO Much! You are a very nice man.”

The man replied “Lady, I am NOT a nice man. I just got out of PRISON yesterday. I was in prison for car theft.”

The woman hugged the man again sobbing, “Oh, thank you, God! You even sent me a Professional!”