“Confidence is that feeling you have before you understand the situation.”

I hope that people’s confidence continues to strengthen, and workers return to work. People returning to work is the key backbone to commercial real estate stabilizing and recovering. Hiring software, such as Indeed, LinkedIn, and ZipRecruiter, has made it super easy to list countless positions and send countless resumes. The problem is that AI technology makes it easy to never see the applicant. Job seekers aren’t getting rejected, they’re just not getting past the technology! My son who is a golf pro was looking for a shop assistant. He got 350 applications, not one had the word “golf” in the resume– leading the software to give him no qualified applicants. We live in an environment that the numbers are not adding up, though it feels like they should. The Bureau of Labor Statistics says there are 8.4 million potential unemployed workers, but it also says there are a record 10.9 million jobs open. The rate people are getting jobs is lower than it was pre-pandemic, and it is taking longer to hire people. Meantime, job seekers say employers are unresponsive. So much for technology making life easier!

This leads me to “fuzzy math” and commercial real estate.

“Fuzzy math” was first introduced to the public during the televised debates between George W. Bush and Al Gore in the 2000 U.S. presidential election. “This man has been disparaging my plan with all this Washington fuzzy math.” How many of you remember this humorous interface? Since then, these terms are frequently used by politicians and others to suggest that their opponent’s numbers are doubtful or are otherwise inaccurate.

How does “fuzzy math” relate to real estate ownership? Sometimes deceptive calculations can result in wide differences in financial outcomes, tax considerations, and the ultimate disposition of real estate.

Here are three definitions of rents:

Current Rent: What you’re collecting now.

Economic Rent: What the market says you’ll receive in rent.

Proforma Rent: What a seller will represent to a buyer that they should be able to get.

- Current Rents: The current rent, also referred to as contract rents, relates to the income generated by the existing owner. These current/contract rents may vary based upon the owner’s management skills or involvement, property condition, existing leases, and overall economic conditions.

- Economic Rents: Otherwise known as market rents is estimated based upon comparable properties in the unique marketplace. This involves compiling current information by property managers or appraisers, considering comparable rental units, and adjusting for quality, location, amenities, and condition of the overall property in a unique market. This is sometimes referred to as, “What will the market bear?”

- Proforma Rents: Sometimes called projected rents or potential gross income. A proforma rent calculation should be the same as “economic rent or projected rent.” Proforma rents are used interchangeably by owners, brokers, appraisers, and lenders. “Projected rents” is a term used to denote what a prospective new owner or new property manager may collect upon taking over ownership or management of the property. In some cases, these projected amounts are based on property upgrades, rehabilitation, and possibly more intensive management of the asset. There may be significant variations in the estimation of expected future possible rents.

The property owner’s goal is to maximize actual net operating income, which begins with maximizing rent collected. Gross scheduled income, less vacancy, fewer expenses equal net operating income.

When a property owner does his tax returns at the end of the year, they are interested in minimizing the income but maximizing the expenses to reduce the federal and state tax burden.

When a property owner loses interest in or mismanages the property, the rents will go down, primarily because of vacancy and diminished condition of the property.

When an owner approaches a lender for financing, the owner gets interested in maximizing the rents, so the property will appraise for more, hence a larger loan amount.

When the property owner passes away, their estate planners and attorneys work ferociously to attempt to lower estate taxes. This may involve showing lower rents and significantly poorer property conditions for tax purposes.

If the economy remains strong, the population grows, and there’s a solid demand for rentals, actual rents will eventually rise to the level of proforma rents.

If the economy doesn’t continue to boom, or worse, goes into the tank, unemployment rises, vacancies arise, and rental amounts collapse, then those proforma rents were simply someone’s optimistic illusion.

Understanding the differences in current rent, economic rent, and proforma rent makes us more confident to handle the situation.

More importantly, you are less likely to get your butt kicked if you can convert “fuzzy math” into “solid math” and know when and where to apply it.

NICK’S NUMBERS

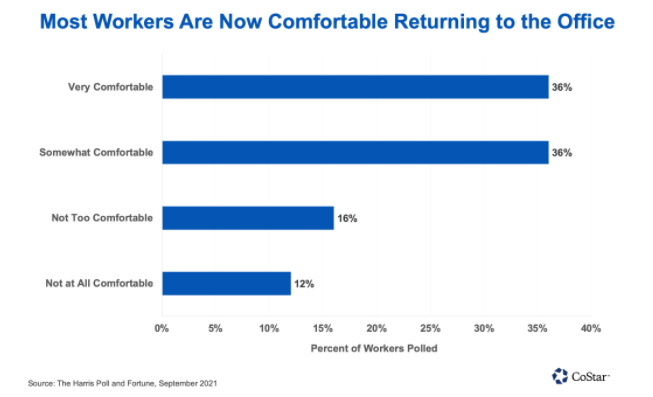

I don’t know about “fuzzy math,” but these charts support what Don said about returning to work and the “great mismatch” that is happening in the job market.

This month, I would like to step past “Nick’s Numbers” and ask you some questions. Call or email me, I would love to discuss your answers and see how we can help.

- We’ve shared what we’re seeing in the market, what are you seeing or experiencing with your tenants/properties or the market?

- Where are you spending more time than you’d like right now?

- Which properties in your portfolio just haven’t turned out like you originally hoped they would?

- Which properties in your portfolio have done better than your expectations?

- Which states that you own property in give you the most concern about their political/economic direction?

- Which category of tenants in your portfolio seems to be having the most problems right now?

- I know you probably monitor collections strategically, which tenants seem to always be late or have trouble paying?

- Which markets that you own property in have seen the slowest rent growth?

- What areas that you currently own property in are you most likely to buy another property in?

- Which areas that you currently own property in are you less likely to buy again? Why?

- Do you have plans to upgrade your portfolio in any way? Which properties might need an upgrade?

- Do you have plans to change your portfolio’s product-type mix? What product type would you like to add to your portfolio?

Please give me a call or email me if you would like an analysis of your properties’ value or to discuss what you should be doing with regards to the Coronavirus pandemic and its impacts on your business, tenants, or property (Nick Zech, 858-232-2100, nzech@cdccommercial.com).

As we enter the last quarter of the year, I am cautiously optimistic. There are still legs to this cycle and plenty of worthwhile opportunities. But the real estate market tends to overheat and then over-correct about every 10 years. That correction is still ahead of us, however, it doesn’t appear to be because of COVID-19 but something will eventually bite us in the rear…I hope you enjoy the story.