The term “ganbatte” is a Japanese art form that means “do your best” or “keep going.” “Ganbatte! The Japanese Art of Always Moving Forward” by Albert Liebermann explains this Japanese philosophy of perseverance, resilience, and continuous improvement.

I recently read that a “positive personal personality preserves athletic performance by decelerating the aging process.” I sure hope so because as you read this, I hope to have finished another half marathon (Boise, ID), knocking off another state in my quest to run a half marathon in all 50 states. I have not quit my quest of a marathon on all seven continents, but COVID and other issues have slowed the quest (4 down, 3 to go).

Early this month, I will make my 63rd pass around the sun. As witnessed above, we don’t always make our goals, sometimes they are pushed out, sometimes we redirect and sometimes we fail, but we must keep moving forward. We don’t always know what works, but doing stuff works. What does that mean? Just this – keep going. Explore ideas. Launch things. Take the risk. Put something out there. Learn from it. Try again. I have seen the problems that crop up when people do the opposite. They stagnate because their ideas don’t seem perfect. They shy away from action because they aren’t sure if it is the exact right one. Then years pass without creating, sharing, or making.

Well, no matter how much you run or persevere, we all know that death and taxes will catch up with you. Some taxpayers may feel they don’t have to worry about estate planning because they have less than $13,610,000 of net assets ($27,220,000 for married couples), which are the current estate tax exemption amounts. However, unless it is changed next year, the estate tax exemption is set to expire on December 31, 2025 and will revert to about $7 mil per person or $14 mil per couple. With real estate values high, it may be surprising how close you are. You should consider reaching out to your tax advisors ideally in 2024 and see how you can use your lifetime annual exclusion or adjust your estate plan before the limits sunset.

While on the subject of taxes, INTUIT®, makers of TurboTax® and QuickBooks® announced it is laying off 215 employees locally as it pursues more Artificial Intelligence investment (in other words AI job replacement). What I found intriguing is that they laid off 1,800 people corporate-wide but announced they were hiring the same number to pursue their AI growth. Somehow, I thought AI was supposed to be replacing jobs.

As I have stated many times, real estate goes up in value in areas where more people are moving in than out. In the years 2020 to 2023, San Diego saw a net outflow of 28,675 people.

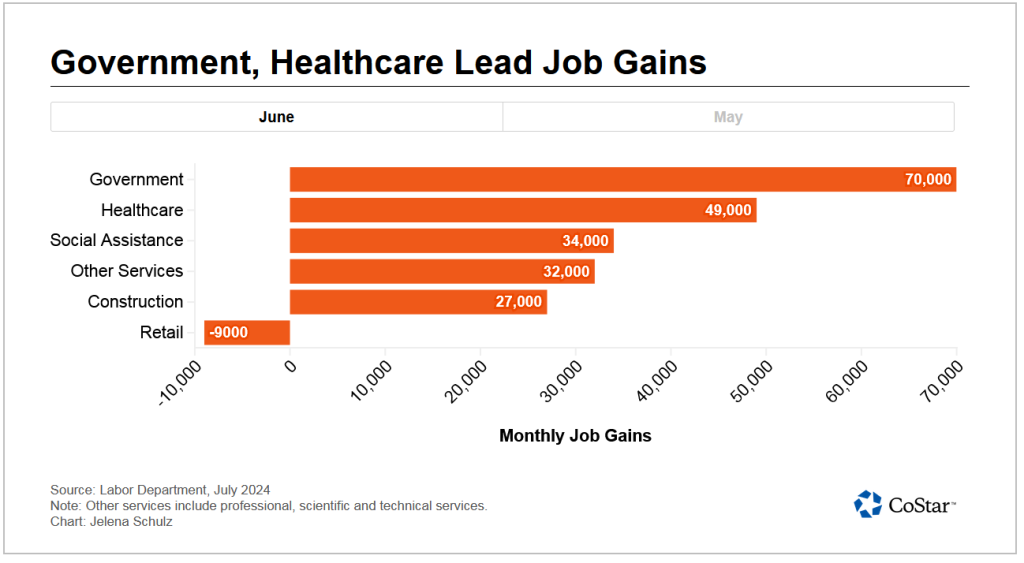

I also continue to say that jobs are the single strongest indicators of health in the Commercial Real Estate (CRE) market. The Labor Department’s June figures show the government being the leading gainer for jobs at 70,000 followed by Healthcare at 49,000 and social assistance increased by 34,000. Jobs are jobs and all but forgive me if I am a little disappointed that these jobs weren’t in categories that build, create, and make things. Nick’s Numbers will shed some more light on the subject.

Interestingly, the housing boom (bubble?) continues, but may be topping off due to affordable issues caused by inflation and high interest rates. To deal with affordability concerns, U.S. consumers are purchasing smaller houses in addition to taking advantage of builder incentives, David O’Reilly, CEO of Howard Hughes Holdings recently told CNBC.

Since the 1980s, new homes have achieved a price premium to existing homes of about 16%, said O’Reilly, but in recent months, he noted the premium dropped to 7%. O’Reilly said that now “new home sales are actually less expensive on a median home price than resales, and I think that shows the consumer adjusting to a smaller home, taking less space and trying to get back into that range of affordability.”

Some existing owners don’t want to let go of the historically low mortgage rates secured during the pandemic by selling now. That has buyers turning to new houses to capitalize on mortgage rate buydowns offered by builders.

The term “ganbatte” is a Japanese art form that means “do your best” or “keep going.” “Ganbatte! The Japanese Art of Always Moving Forward” by Albert Liebermann explains this Japanese philosophy of perseverance, resilience, and continuous improvement.

I recently read that a “positive personal personality preserves athletic performance by decelerating the aging process.” I sure hope so because as you read this, I hope to have finished another half marathon (Boise, ID), knocking off another state in my quest to run a half marathon in all 50 states. I have not quit my quest of a marathon on all seven continents, but COVID and other issues have slowed the quest (4 down, 3 to go).

Early this month, I will make my 63rd pass around the sun. As witnessed above, we don’t always make our goals, sometimes they are pushed out, sometimes we redirect and sometimes we fail, but we must keep moving forward. We don’t always know what works, but doing stuff works. What does that mean? Just this – keep going. Explore ideas. Launch things. Take the risk. Put something out there. Learn from it. Try again. I have seen the problems that crop up when people do the opposite. They stagnate because their ideas don’t seem perfect. They shy away from action because they aren’t sure if it is the exact right one. Then years pass without creating, sharing, or making.

Well, no matter how much you run or persevere, we all know that death and taxes will catch up with you. Some taxpayers may feel they don’t have to worry about estate planning because they have less than $13,610,000 of net assets ($27,220,000 for married couples), which are the current estate tax exemption amounts. However, unless it is changed next year, the estate tax exemption is set to expire on December 31, 2025 and will revert to about $7 mil per person or $14 mil per couple. With real estate values high, it may be surprising how close you are. You should consider reaching out to your tax advisors ideally in 2024 and see how you can use your lifetime annual exclusion or adjust your estate plan before the limits sunset.

While on the subject of taxes, INTUIT®, makers of TurboTax® and QuickBooks® announced it is laying off 215 employees locally as it pursues more Artificial Intelligence investment (in other words AI job replacement). What I found intriguing is that they laid off 1,800 people corporate-wide but announced they were hiring the same number to pursue their AI growth. Somehow, I thought AI was supposed to be replacing jobs.

As I have stated many times, real estate goes up in value in areas where more people are moving in than out. In the years 2020 to 2023, San Diego saw a net outflow of 28,675 people.

I also continue to say that jobs are the single strongest indicators of health in the Commercial Real Estate (CRE) market. The Labor Department’s June figures show the government being the leading gainer for jobs at 70,000 followed by Healthcare at 49,000 and social assistance increased by 34,000. Jobs are jobs and all but forgive me if I am a little disappointed that these jobs weren’t in categories that build, create, and make things. Nick’s Numbers will shed some more light on the subject.

Interestingly, the housing boom (bubble?) continues, but may be topping off due to affordable issues caused by inflation and high interest rates. To deal with affordability concerns, U.S. consumers are purchasing smaller houses in addition to taking advantage of builder incentives, David O’Reilly, CEO of Howard Hughes Holdings recently told CNBC.

Since the 1980s, new homes have achieved a price premium to existing homes of about 16%, said O’Reilly, but in recent months, he noted the premium dropped to 7%. O’Reilly said that now “new home sales are actually less expensive on a median home price than resales, and I think that shows the consumer adjusting to a smaller home, taking less space and trying to get back into that range of affordability.”

Some existing owners don’t want to let go of the historically low mortgage rates secured during the pandemic by selling now. That has buyers turning to new houses to capitalize on mortgage rate buydowns offered by builders.

Nick’s Numbers

This month I have two charts to illustrate our point. First, private job openings are steadily dropping and the second chart shows a lot of the current job growth is taxpayer funded.

If you would like an analysis of your properties’ value or discuss what you should be doing concerning interest rates or inflation and their impacts on your business, tenants, or property, I’d be happy to talk. (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

I have written a lot about the benefit’s of 1031 exchanges (and we have done a bunch of them!). Mostly I have addressed how great they are at deferring gain and not paying taxes (defer until you die and refi to live!). Most of us know you can’t receive cash at closing (boot) if you don’t want to pay taxes. However, it is important to also remember that if you refi before the up leg or after the down leg you might get called out by the IRS. Basically, the refinance needs to be an “independent economic substance.” In other words, for a business purpose not just to avoid paying taxes. Here is a link to a more detailed guideline to safely refinance a 1031 property.

So, whether you are dealing with the IRS, The Department of Energy, or leasing your building to some of those 70,000 new government employees, I hope you find your ganbatte or at least enjoy this month’s story…

The Night Watchman

Once upon a time the government had a vast scrap yard in the middle of a desert.

Congress said, “Someone may steal from it at night.”

So they created a night watchman position and hired a person for the job.

Then Congress said, “How does the watchman do his job without instruction?”

So they created a planning department and hired two people, one person to write the instructions, and one person to do time studies.

Then Congress said, “How will we know the night watchman is doing the tasks correctly?”

So they created a Quality Control department and hired two people. One was to do the studies and one was to write the reports.

Then Congress said, “How are these people going to get paid?”

So they created two positions: a time keeper and a payroll officer then hired two people.

Then Congress said, “Who will be accountable for all of these people?”

So they created an administrative section and hired three people, an Administrative Officer, Assistant Administrative Officer, and a Legal Secretary.

Then Congress said, “We have had this command in operation for one year and we are $918,000 over budget, we must cut back.”

So they laid-off the night watchman.

NOW slowly, let it sink in.

Quietly, we go like sheep to slaughter. Does anybody remember the reason given for the establishment of the DEPARTMENT OF ENERGY during the Carter administration?

Anybody?

Anything?

No?

Didn’t think so!

Bottom line is, we’ve spent several hundred billion dollars in support of an agency, the reason for which very few people who read this can remember!

Ready??

It was very simple… and at the time, everybody thought it very appropriate.

The Department of Energy was instituted on 8/04/1977, TO LESSEN OUR DEPENDENCE ON FOREIGN OIL.

Hey, pretty efficient, huh???

AND NOW IT’S 2024 — 47 YEARS LATER — AND THE BUDGET FOR THIS “NECESSARY” DEPARTMENT IS AT $51 BILLION A YEAR. IT HAS 16,000 FEDERAL EMPLOYEES AND APPROXIMATELY 100,000 CONTRACT EMPLOYEES.

Ah, yes — good old Federal bureaucracy.

NOW, WE HAVE TURNED OVER THE BANKING SYSTEM, HEALTH CARE, AND THE AUTO INDUSTRY TO THE SAME GOVERNMENT?

Signed….The Night Watchman