When this is over may we never again take for granted; a handshake with a stranger, full shelves at the store, conversations with neighbors, a crowded theater, Friday night out, the taste of communion, a routine checkup, the school rush each morning, coffee with a friend, the stadium roaring, each deep breath, a boring Tuesday, life itself.

When this ends, may we find that we have become more like the people we wanted to be, we were called to be, we hoped to be, and may we stay that way – better for each other because of the worst.

Laura Kelly Fanucci

This year is different. We are in a transition, but so much is still the same. That which isn’t the same is vague and unknown. We are far enough into the upheaval of 2020 to know we aren’t going back, but we still don’t know what lies ahead. The familiarity is gone, leaving us struggling to find our footing.

I recently read in The Atlantic that; army ants will sometimes walk in circles until they die. The workers navigate by smelling the pheromone trails of workers in front of them, while laying down pheromones for others to follow. If these trails accidentally loop back on themselves, the ants are trapped. They become a thick, swirling vortex of bodies that resembles a hurricane as viewed from space. They march endlessly until they’re felled by exhaustion or dehydration. The ants can sense no picture bigger than what’s immediately ahead. They have no coordinating force to guide them to safety. They are imprisoned by a wall of their own instincts. This phenomenon is called the death spiral. I can think of no better metaphor for our place in history.

If you think the last six months have been a trip, hang onto your seat for the next six months, because I think we have experienced a tumultuous earthquake, but we have yet to see the tsunami. I know in past letters, I have spoken about the need to adapt, innovate and overcome but this month I am going to tell you in the months ahead, that when the going gets tough, the tough get going.

When the government ends juiced unemployment benefits, the Paycheck Protection Programs (PPP) for small businesses, and forbearance plans for income strapped borrowers – when the government ends foreclosure and eviction moratoriums that unquestionably prop up the housing market – only then will we get a clearer picture where prices (and the economy) are heading.

When the tide change and goes back out, we will learn who had a bathing suit on and it might not be pretty.

The real estate market is struggling to determine if there has been a reset in property values. Keep in mind that property pricing is not the same as property value. Pricing is what someone offers the property for and another is willing to pay for it. Value is largely based upon the cost to build the property and what amount of income it produces. The disconnects right now are that some properties are not throwing off income and may never do so again, others are ticking along as if nothing has happened. Values have fallen much faster than pricing, but we are not observing it yet because there has been a huge fall off in transaction volume. Buyers have decreased but sellers have either taken properties off market or just not been willing to put property on the market in the first place. This leaves a sort of vacuum. Many businesses and property owners went into COVID-19 in a strong position following a strong economy, meaning they are not feeling pressure to close or sell…yet…

However, we are seeing lenders starting to pivot and discount COVID impacts on income, avoid product types, and slow down their loan pipeline. Loan delinquencies have risen. FDIC reports about a 42% increase over year end 2019 with about 1% of loans now delinquent.

The food industry estimates that 33,000 U.S. restaurants and drinking establishments have permanently closed in the first five months of the pandemic. Twenty-five percent indoor capacity won’t “cut the bill” for most restaurants, especially when weather kills outside dining. Eighty-seven percent of NYC restaurants didn’t pay full rent in August.

The other phenom hitting commercial real estate now is work from home (WFH). There’s no question there are many advantages to WFH. Commutes measured in steps, fewer interruptions from co-workers, more time with family. However, the novelty may soon wear off – the honeymoon may be coming to an end. The blind spot for companies is their belief that all employees prefer working from home. However, many struggle with figuring out how to separate work from home. Employers like the WFH productivity boost and the reduction in office overhead. But it isn’t because employees are more efficient, it is often because they are working longer as the line between work and home disappears. Our beloved digital devices create an “always on duty” workplace culture. In the future, employees who have no alternative but to work from home may leave without the employer ever knowing why. Employers are not accounting for the high cost of this turnover on their hiring, training, and custom relationships. Finally, the WFH culture doesn’t account for your co-workers and managers knowing if you are having a bad day or having personal issues (cause those are just not communicated in a zoom call or text). JP Morgan has already recognized the problem and recycled its employees back to the office. CEO Jamie Dimon told analysts that productivity was particularly affected on Mondays and Fridays. He added, “overall productivity and creative combustion has taken a hit.” I am going to tell you that the first time a company sees its competitor being more successful with an “in office” strategy, will be the end of wholesale work from home strategies. Employers had best be careful when they close the office door.

The WFH movement is affecting the home buyer market too. Buyers are moving sooner than expected and to a much broader range of geographic locations. Of course, they are seeking homes with dedicated office space. Interestingly, only 14% surveyed said they don’t anticipate ever returning to the office.

In the meantime, telehealth is a trend that I think is here to stay and will impact and reshape healthcare real estate. The pandemic and changes in insurance reimbursements have created the critical mass to make tele-medicine mainstream. Medical offices will have less need for treatment rooms but more demand for call rooms for doctors and techs, as well as remote monitoring and diagnostic equipment. Internet redundancy, appropriate lighting, screens, acoustics, and privacy (HIPPA) compliance will be critical. Smaller waiting rooms and larger common area may happen as doctors employ text and paging services like restaurants.

I try to stay as non-political as I can, but if you aren’t already aware, Prop 15 is proposing the largest property tax increase in California history. The measure is focused on lifting Prop 13 protection of commercial properties. Unfortunately, the tax increase will be passed down to tenants since most leases are triple net. Those owners without triple net leases or without expense pass thru provisions are likely to see about a 10% -20% or more decrease in your income! (Take what you think your property is worth, subtract what you paid for it and multiply by .012 and that will be the the amount of the annual tax increase that you will be passing along or deducting from your income!). Expect Disneyland tickets to skyrocket!

The groups most vulnerable to the effects of COVID-19 closures are being hit at the worst of times. With many barely hanging on, this may be the fatal blow. Be sure to let your tenants know and tenants your customers. This bill will flow the tax down to all of us in the form of higher rent and goods and services.

Nick’s Numbers

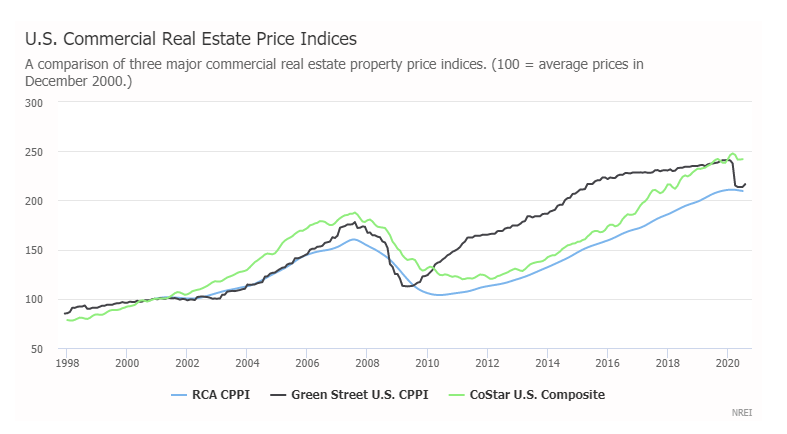

This month I am sharing a chart that shows the beginning of the price drop discussed by Don above. If you are interested in talking about selling, buying or leasing give me a call or drop me an email.

Please give me a call or email me if you would like an analysis of your properties’ value or to discuss what you should be doing with regards to the Coronavirus pandemic and its impacts on your business, tenants, or property (Nick Zech, 858-32-2100, nzech@cdccommerical.com).

I hope you enjoy this month’s, tongue in cheek ultimate work from Heaven story…

What Happens when God and Staff Work from Home

If you are like me, you have been having your share of issues with companies help desks during this work from home time. I recently spent over an hour on the phone with a customer support person who assured me that they could help me with my problem. After 20 minutes they realized they needed tech support but couldn’t transfer me since they were both working from home, so we spent the next 30 minutes with them text messaging each other and relaying questions and answers to me. Upon realizing this wasn’t working, the dynamic duo suggested I needed advanced support (could have told you that), however, they were unable to connect me because everyone was working from home and very back logged. They assured me someone would call me back in 3-5 days. That was a couple of weeks ago.

All of this leads me to question, what would happen if God and his staff had to work from home…

Most of us have now learned to live with automated help as a necessary part of our lives. Have you ever wondered what it would be like if God decided to install voice mail? Imaging praying and hearing the following:

Thank you for calling Heaven.

For English press 1

For Spanish press 2

For all other languages, press 3

Please select one of the following options:

Press 1 for request

Press 2 for thanksgiving

Press 3 for complaints

Press 4 for all others

I am sorry, all our Angels and Saints are busy helping other sinners right now. However, your prayer is important to us and we will answer it in the order it was received Please stay on the line.

If you would like to speak to:

God, press 1

Jesus, press 2

Holy spirit, press 3

All others, press 4

To find a loved one that has been assigned to Heaven press 5, then enter their social security # following by the pound sign.

If you receive a negative response, please hang up and dial area code 666.

For reservations to heaven, please enter JOHN following by the number 3 16.