He was a lowly intern in Philadelphia picking up dry cleaning or fast food for coaches… He was promoted to a coach’s assistant for a few years and then a scout for a few more. A decade later in Kansas City, he was mesmerized by a player on video no one else saw. “What’re you watching? Kansas City Chiefs Coach Andy Reid asked Brett Veach. “The next quarterback of the chiefs,” replied Veach. He wasn’t just enamored by Mahomes, he was borderline obsessed. He contacted Mahomes’ agent for 94 straight days heading into the draft. Yet no one saw it. When Mahomes was drafted he was graded as a C+ pick at best. Yet with that one value-based decision, one man is the face of the NFL (maybe not as much after Sunday’s loss to the Bengals!), and one lowly intern is the general manager of the Kansas City Chiefs!

I keep reading the economists prognosticating that 2022 will be a strong growth year, and no stop to rising markets (real estate, stocks, etc.). However, I am reminded of the quote, “Economists know the price of everything but the value of nothing.” Just remember that market conditions can and do change. Football analysts, economists, and investors like to believe things will continue to be the same in the future as they are now. This is called, “normalcy bias.” We’re still in that fear of missing out (FOMO) stage. Rates are rising and buyers of property (residential and commercial) are trying to jump in before they go up further. Eventually, the pendulum swings to FOBO – fear of better opportunities. This phenomenon occurs when buyers hold back because they are afraid prices will go down further. It is also referred to as, “Don’t try to catch a falling knife.”

To be clear, I am not saying we are in a bust, but trees don’t grow into the clouds. At the same time, commercial property investors have been getting it wrong for two years waiting for distressed sales which haven’t materialized. The apartment industry thought it would face an eviction crisis, instead, rent grew 11% and owners hung on and many sold for record prices. The pandemic killed almost all retail but in 2021 there were more store openings than closings. Unemployment levels skyrocketed during the pandemic, yet unemployment rates are now near pre-pandemic levels. Another one we got wrong is inflation. Fed Chair Jerome Powel said inflation is “transitory” but it doesn’t appear to be coming down anytime soon.

President Calvin Coolidge once said that inflation is repudiation. Webster defines repudiation as, “an act or declaration before performance is due under a contract that indicates that the party will not perform his or her obligations.” Thought-provoking!

During recessions, central banks typically respond by cutting interest rates, which stimulates the economy by encouraging more borrowing and reducing the relative debt cost. This process of debt accumulation and lowering interest rates repeats itself for decades. When interest rates hit the floor at 0% it marks the beginning of the end of the long-term debt cycle and the start of a deleveraging period where central bankers begin to devalue their currencies. Interest rates can no longer be lowered because they are at zero. Therefore, policymakers only have two remaining options: quantitative easing (i.e., printing money and buying financial assets) or printing money and putting it directly into the hands of people in the form of stimulus payments. In the words of Ray Dalio: “When the risk-free interest rate that they control hits 0% in a big debt crisis, central banks lowering interest rates doesn’t work. That drives them to print money and buy financial assets. That happened in 1929-33 and 2008-09. We call the power of central banks to stimulate money and credit growth in these ways “the amount of fuel in the tank.” Right now, the world’s major central banks have the least fuel in their tanks since the late 1930s so are now in the later stages of the long-term debt cycle.”

The late economist and stock picker Richard Russell used to say, “inflate or die.” He meant that the Fed was committed to fighting deflation and when faced with debt, they would crank up the printing presses.

What stops inflation? People’s belief and acceptance that it is contained. How does that happen? Interest rates go up and everything else goes down (yes, that includes real estate). Then the Fed steps in – see paragraph above. Goldman Sachs recently predicted that the Federal Reserve will be raising rates four times in 2022 (up from earlier predictions of three times).

Goldman Sachs also reports that 98% of small business owners in CA report that labor shortage is affecting their bottom line. Eighty-one percent report inflation, 77% site supply chain, and 70% say COVID-19 is dragging on their bottom line. The mystery to me, however, is the disappearing workforce. Although the San Diego unemployment rate has dropped to 4.2% in December (5% for CA and 3.7% for the U.S.), we still have almost a million fewer workers employed in California than in January 2020 before the pandemic.

One thing you can expect to go up is property insurance. The supply chain and inflation are making repairs to commercial properties more expensive with higher costs for labor, lumber, and steel.

NICK’S NUMBERS

Please give me a call or email me if you would like an analysis of your properties’ value or to discuss what you should be doing with regards to the Coronavirus pandemic and its impacts on your business, tenants, or property (Nick Zech, 858-232-2100, nzech@cdccommercial.com).

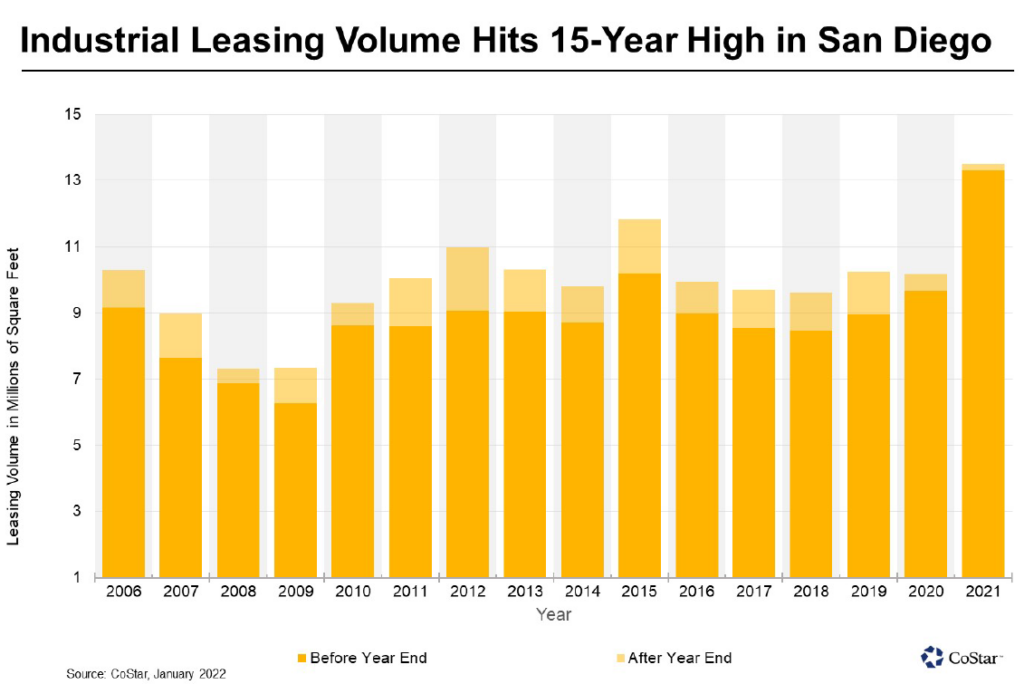

Another thing that boomed in the pandemic despite predictions was the industrial market! Biotech accounted for 15% of the new office and industrial leasing in San Diego in 2021. Amazon signed 4 leases in the County for almost 2 million square feet accounting for 13% of completed leases in 2021.

A little early but Happy Valentines Day to you. Did you know that chocolate manufacturers currently use 70% of the world’s almonds and 20% of the world’s peanuts? And now for the interactive part of this letter. Email me and let me know if 2021 were a candy, what would it be? And if 2022 were a candy, what would it be?

This month’s story is a video production that I thought you would like. It is a bachelor-like episode poking fun at what it is like as a tenant being courted by a property owner (get it – won’t you be my Valentine humor!). Hope you enjoy it…