In the opening scene of Shakespeare’s Macbeth, the witches gather around a cauldron making a potion and chanting, “Double, double toil and trouble; fire burn and cauldron bubble.” Well, let me tell you that a bubble’s famous last words are always, “I’ll be back!” The Fed is in an unenviable position of controlling rampant inflation and not creating too much unemployment. Obviously, we are at the end of ZIRP (Zero Interest Rate Policy) because ZIRP requires printing money and that causes inflation. As stated, the Fed is trapped, and it must choose to fight inflation or refuel the stock market bubble (so ZIP for ZIRP!).

With interest rates rising, we are seeing pressure on cap rates. Thus far, we are seeing some slow down in deal volume. Buyers struggle with interest rates and inflation and sellers are slow to accept price reductions.

Speaking of sellers being slow to accept price changes, I thought it might be worth sharing my phases of a seller going through an economic cycle.

Market is strong – “Not interested in selling, it’s still going up.”

Market is turning – “Ok, I will sell but I want higher than what you are telling me.”

Market starts down – “I’m not accepting that, I had higher offers last year.”

Market keeps going down – “I had higher offers two years ago. I’ll wait until it comes back.”

Market really goes down – “I can’t believe I could have gotten so much 2 ½ years ago. I can’t afford to sell now because all I will be able to do is pay off the loan and commission.”

Market in free fall – “It’s never coming back. Commercial real estate sucks! The world has changed forever. Why should I keep paying the bank when it’s worth less than the loan? Can you sell it for more than the loan or work out a short sale for me?”

Back to inflation, I would like to point out that rent and real estate prices are not directly indexed to inflation. Inflation looks like a straight line, but rent and price increases tend to come in bumps and bursts. There are many times where rents go up by CPI and end up much higher than what the market goes up. Rents need to stay between 7% and 15% of gross sales. So, in an inflationary time as long as the tenant has pricing power to raise prices, then they can stomach increased rent. But, if they are not able to increase prices and their expenses (including rent) go up, then they will quickly go out of business.

In the end, however, real estate is one of the best hedges of inflation. That is because as it costs more to build (materials and labor increase), they have to ask more for rent, so existing buildings have margin to raise rents but stay below the new building rents. Eventually tenants all pass it on in their prices. Higher rents equal higher prices and the world keeps moving!

Besides interest rates, inflation, and supply chain issues, you have probably noticed all of the businesses with staffing shortages. The courts and Sheriff’s Departments are facing critical staff shortages and experiencing significant backlogs due to the increased number of eviction filings. It is anticipated that due to the current influx of cases being filed, it will further set back the courts and Sheriffs Departments and will delay their ability to process the volume of cases in a manner most landlords are accustomed to and unfortunately, these are not minor delays. In many jurisdictions, it is taking closer to two months to schedule a lockout as opposed to the two to three weeks it used to take before the COVID-19 pandemic.

I was recently on a flight from LA to Monterey (yes to play a once in a lifetime round of golf) and noticed the plane was filled with bankruptcy attorneys and judges. Turns out, they were heading to a bankruptcy convention (didn’t know there were such things). The buzz was loud, and the energy was palpable. They left some of their materials on the seat and I read the following – which explains the lawyers’ excitement.

“Bankruptcies declined abnormally during the 2020-2021 pandemic period. Without fuel from stimulus and inflation, bankruptcies would have risen significantly in 2020-2021. Just 6,100 business bankruptcies were filed in California during 2021, a fraction of the 63,200 California filings during the 2011 peak year following the 2008 recession.

But today, the economy has started to contract as it ushers in the second act of the 2020 recession. Expect a cyclically disproportionate rise in bankruptcy filings in the next three years, likely exceeding the aftermath of the 2008 recession. For the housing market, leveraged owners who see the equity in their property disappear often file bankruptcy petitions when job loss occurs. Watch for more personal and business bankruptcies, beginning to rise in 2023 and peak in 2026.”

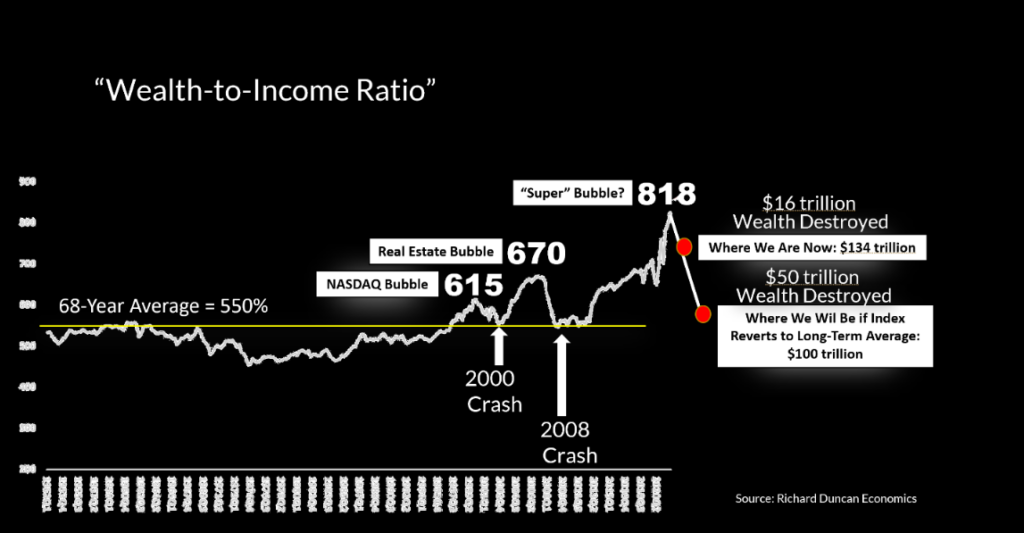

According to Richard Duncan of Duncan Economics, between 2009 and the end of 2021, household sector wealth soared by 150%, increasing from $60 trillion to $150 trillion. To track the household sector wealth, the Fed publishes an index called Household Net Worth as a Percentage of Disposable Personal Income. The index, which is commonly referred to as the Wealth-to-income Ratio, has a 68-year average of 550%. It’s interesting to observe how the index behaved in the face of past examples of record-high stock prices. For example, in March 2000, the index reached a then, all-time high of 615%. Notable for sky-high valuations of soon-to-be failed companies such as WorldCom, Global Crossing, NorthPoint Communications, Alta Vista, InfoSpace, Pets.com, Ask Jeeves, and Excite, this was the apogee of the “dot-com bubble” that burst shortly thereafter. By October of 2002, the NASDAQ 100 had fallen by 78%.

How did the wealth-to-income ratio react? The index reverted to its long-term average of 550%.

In October 2007, the wealth-to-income ratio reached another all-time high of 670%. Over the next 18 months, the Dow fell by more than 50%. The index? It again fell right back to its long-term average of 550%.

As of June 30, 2022, the wealth-to-income ratio stood at a never-before-seen level of 818%. Due of the sell-off in stocks, $16 trillion of wealth has already been destroyed this year, dropping total household wealth to $134 trillion. If over the next several months, the index once again falls back to its long-term average, we can expect an additional $34 trillion in wealth destruction, taking total household sector wealth from $150 trillion down to $100 trillion.

Nick’s Numbers

Please give me a call or email me if you would like an analysis of your properties’ value or discuss what you should be doing with regards to interest rates or inflation and their impacts on your business, tenants, or property (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

On a positive note, San Diego has finally surpassed its pre-pandemic employment level. Unemployment was 3.2% in San Diego in June. That bodes well for real estate values in the meantime since employment and real estate value are the most directly correlated. Despite these great employment numbers, Lending Club reports that people have horrendous financial literacy with over 36% of Americans making over $250,000 a year reportedly are living paycheck to paycheck.

With another birthday coming this month, I am fastening my seat belt for another trip around the sun. Enough doom scrolling for now. The sun will still come up tomorrow. Just remember what it takes to be rich…hope you enjoy the story.

What makes a person rich?

One day a father of a very wealthy family took his son on a trip to the country with the firm purpose of showing his son how poor people live. They spent a couple of days and nights on the farm of what would be considered a very poor

family.

On their return from their trip, the father asked his son, “How was the trip?”

“It was great. Dad.”

“Did you see how poor people live?” the father asked.

“Oh yeah,” said the son.

“So, tell me, what did you learn from the trip?” asked the father.

The son answered: “I saw that we have one dog and they had four. We have a pool that reaches to the middle of our garden, and they have a creek that has no end. We have imported lanterns in our garden, and they have the stars at night. Our patio reaches to the front yard, and they have the whole horizon. We have a small piece of land to live on and they have fields that go beyond our sight. We have servants who serve us, but they serve others. We buy our food, but they grow theirs. We have walls around our property to protect us, they have friends to protect them.”

The boy’s father was speechless.

Then his son added, “Thanks, Dad, for showing me how poor we are.”