“It was a bright cold day in April, and the clocks were striking thirteen.” ~ opening line of George Orwell’s book 1984

This line seems innocuous enough, but you immediately know something is wrong with the world. As a writer, I recognize this is done to drive the reader to find out what. As a citizen, when I see a $750 billion spending bill get approved that is called an inflation-fighting bill, I am thinking it is 13 o’clock!

This line seems innocuous enough, but you immediately know something is wrong with the world. As a writer, I recognize this is done to drive the reader to find out what. As a citizen, when I see a $750 billion spending bill get approved that is called an inflation-fighting bill, I am thinking it is 13 o’clock!

Gun control has increased gun ownership, the Mira Lago search has raised more funds for Trump, Whole Foods CEO warns about socialism, Chase CEO Jamie Dimon says the economy is “strong” and consumers’ balance sheets are in “good shape,” however warns that “something worse” than a hard recession looms.

The fact that the Fed was surprised by the persistence of inflation (after saying it was transitory) is like yelling “fire” in a theater and being surprised by the stampede because you had fire extinguishers and sprinklers throughout the building.

My new way to process truth in news and politics is as follows; listen to both sides and believe the exact opposite! My dad used to say, “when you watch a magician, watch his other hand.” During these crazy times I work hard to follow my ANTS philosophy (Avoid Negative ThoughtS). Former General and Secretary of State Colin Powell had 13 rules of life and rule #13 was – “perpetual optimism is a force multiplier.” At CDC Commercial, we abide by that rule!

I am optimistic to see schools back open and students returning without masks.

I know I said be optimistic, but a couple of negatives first. The 2-year and 10-year Treasury rules have been inverted for about a month. This is a sign that the bond market expects a recession in the next six months. The second negative is negative leverage has come back to commercial real estate (borrowing rates higher than cap rates). Interest rates have risen but cap rates haven’t. A key axiom in developing and investing in commercial real estate is buying real estate where the cap rate is higher than the cost of debit. This means the return on your equity (cash on cash) will be greater than the cap rate. If you don’t have a 20-year horizon, then its necessary to look to properties where you can increase cash flow dramatically in order to outpace inflation.

Something that is happening more is, “retrading.” This is where a buyer gets under contract and prior to closing looks for a significant price adjustment tied to an increase in interest rates or deal risk. More investors will be demanding higher cap rates soon which will put downward pressure on prices. I think we are entering a “hold” phase with prices leveling or decreasing for 12-24 months.

How do we beat inflation? I know in business and government it involves slashing spending and budgets. However, in your life here are a few ideas.

- Review and get rid of paid subscriptions – newsletters, gym memberships, subscription home delivery services, music services, etc.

- Buy recycled or refurbished products

- Buy direct – see if you can buy from producer or wholesaler

- Use technology – price compare – price match. Technology like Gas Buddy or the AAA app to find the cheapest gas near you at the moment.

- Can you offshore anything? India, Philippines, even Australia offer lots of services that even an average person can use. I know a 14-year-old that uses a Philippines tech firm to mine crypto for him.

- Better use of tools you have – have you looked at your Microsoft Office subscription and looked at what all it can do or how to better use Word, Excel or Outlook? Have you learned to use Lens on your phone to take a picture and turn it into a PDF?

- Save on travel costs by becoming an expert of Zoom or Teams. Can you turn your camera on and off quickly, mute your mic, share your screen with others, create work rooms to send others to on large group calls?

I have said for a long time that the health of the commercial real estate market revolves around the labor market, namely jobs and unemployment. Here again I am bewildered as to the truth. After loosing 22 million jobs in two months in 2020, the Bureau of Labor Statistics is finally reporting that we have recovered to pre-pandemic levels. However, if we had continued the trajectory, we were on from 2017-2019, we would have had an additional 5.5 million jobs by this time.

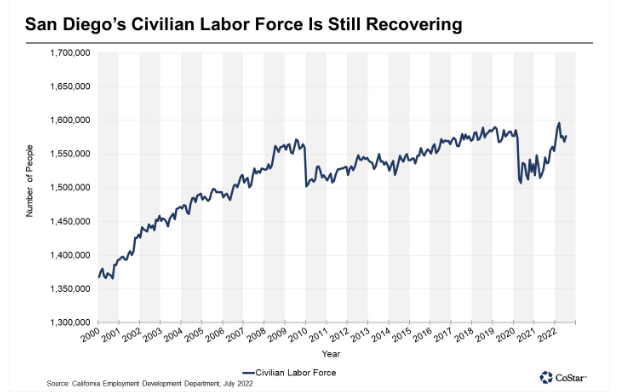

San Diego’s labor force is still in recovery. San Diego lost about 6,700 jobs in July (CA Employment Development Department) yet unemployment went down to 3.1% (Don’t ask me). Although, we added more than 11,000 jobs in the office sector in the last 12 months, the financial services sector lost 600 jobs in July. I think this is the sector to watch as residential real estate finance and refinance-related fields (mortgage companies, escrow companies, real estate offices) shrink. Additionally, as more and more companies move to remote or hybrid, we are seeing a rocky office market. Hiring figures may no longer represent a definitive indicator of the office sector’s stability.

A case in point would be Geico Insurance opting to leave all of its brick-and-mortar space in California including its 267,000-square-foot facility in Poway. In January, Farmers Insurance did the same shift to remote and vacated 500,000 SF in Woodland Hills. However, no layoffs were announced – everyone is working from their couch with a green gecko on their shoulder.

Another rule of thumb I always use is that you want to buy real estate where more people are moving in than moving out. San Diego’s population fell in 2021 according to U.S. Census data. Yet apartment vacancy rates are at 2.6% and rents are up 20%! Is it 13 o’clock yet?

Nick’s Numbers

This month I am sharing a chart that illustrates Don’s point of San Diego’s continued employment recovery.

Please give me a call or email me if you would like an analysis of your properties’ value or discuss what you should be doing with regards to interest rates or inflation and their impacts on your business, tenants, or property (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

With the clock striking 13 and the kids going back to school, I hope you enjoy the story…

The Animal School

Once upon a time, the animals decided they must do something heroic to meet the problems of the “new world” so they organized a school. They adopted an activity curriculum of running, climbing, swimming, and flying. To make it easier to administer the curriculum, all the animals took all the subjects.

The duck was excellent in swimming, in fact better than his instructor, but he only made passing grades in flying and was very poor in running. Since he was slow in running, he had to stay after school and also drop swimming in order to practice running. This was kept up until his web feet were badly worn and he was only average in swimming. But average was acceptable in school, so nobody worried about that except the duck.

The rabbit started at the top of the class in running but had a nervous breakdown because of so much make up in swimming. The squirrel was excellent in climbing, but he developed frustration in the flying class where the teacher made him start from the ground up instead of from the treetop down. He also developed charley horses from overexertion and then got C in climbing and D in running. The eagle was a problem child and was disciplined severely. In the climbing class he beat all the others to the top of the tree, but insisted on using his own way to get there.

At the end of the year, an abnormal eel that could swim exceedingly well, and also run, climb and fly a little had the highest average and was valedictorian.

The prairie dogs stayed out of school and fought the tax levy because the administration would not add digging and burrowing to the curriculum. They apprenticed their child to a badger and later joined the groundhogs and gophers to start a successful private school.

George H. Reavis