Welcome to the New Year! We look forward to another productive and prosperous year as we herd cats with the clicks of our mouse! In the meantime, I hope to torture the data until it confesses!

Despite what social media and the news would have us think, there is much good news and things to be thankful for going into 2026. First and foremost, CDC Commercial had another successful year and are setting up for what looks like a very successful 2026!

The consumer will propel the economy forward once again in 2026. It’s crazy but consumer sentiment is near all-time lows, yet sales continue to grow.

Business investment will continue as AI spreads out to other sectors. Massive amounts of capital have been invested into data centers and power structures, and yes, a bubble is likely. It’s crazy, the tech sector is only 4% of the total GDP, but it has contributed a staggering 92% of its growth this year!

At some point, people will sense the music stopping and the 70% annual stock gains of Nvidia will settle down and investors will settle for the ho-hum 6%-7% unleveraged annual returns for real estate. Without AI infrastructure growth, GDP growth would have been a paltry 0.1% – barely above zero!

Inflation has come down from its peak of 7.1% in mid-2022 and sits at about 2.8%, which is still above the Fed’s target of 2%. However, if housing prices soften as expected, inflation will ease further.

The housing market is broken and it’s not going to be fixed just by lowering rates. Artificially low rates for the last five years, combined with the government spending trillions of dollars it didn’t have, is not sound economics. This deficit spending devalued the dollar, making more dollars needed to buy a home, and low interest rates allowed buyers to borrow more to bid up the price of homes. Lowering rates again won’t fix the problem, it will have the opposite effect. The real solution is to get the government out of the way by spending less and creating less demand for borrowed money. Only fiscal restraint will fix the problem.

In the meantime, in the commercial real estate world, buyers can no longer assume real estate values will rise as fast as they did during those low-interest rate days. Instead, income is king again. New construction has been muted because of inflation. Construction costs have skyrocketed over 40% since 2020. This is a good sign for existing owners where little has been built and, in some cases, demolished for housing. As supply tightens, landlords have the power to raise rents. In theory, a 40% increase in building costs means a 40% increase in rent before new construction makes sense again. This points to an extended period of rent increases before new supply enters the market.

More CRE good news: U.S. commercial real estate prices climbed in October, extending their winning streak to five months, a sign of stabilization. This is according to the CoStar Repeat-Sale Indices that tracks when previously sold properties trade hands again, called a repeat sale.

On another positive note, the Regional Task Force on Homelessness reported a 13% year-over-year drop in people falling into homelessness and a 17% uptick in people moving into homes. Unfortunately, at the same time, the number of Americans dealing with food insecurity has almost doubled since 2021.

But here is one for you. I read an article by Adam Mostroianni that reports there is a decline in deviance. Yep, that’s right, despite what you see and hear in the news and social media, people are less weird than they used to be! Kids are half as likely to drink alcohol as they were in the ‘90s. They’re also less likely to smoke, have sex or get in a fight. But are they more likely to lie on surveys? Maybe, but teenage pregnancy has also plummeted since the ‘90s and that’s a little tougher to lie about!

Nick’s Numbers

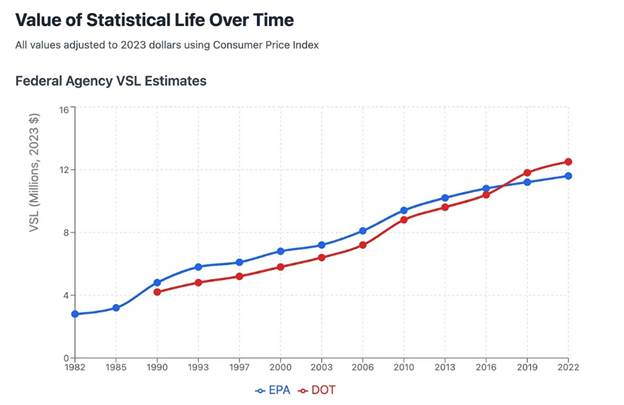

I read the same article my dad referenced above and thought about what fewer risky behaviors mean in economic terms. One way this shows up is in the government’s estimate of the “value of statistical life,” which has risen over time. The chart below shows just how much that value has increased.

If you would like an analysis of your property’s value or discuss what you should be doing with regard to interest rates or inflation and their impacts on your business, tenants, or property, I’d be happy to talk. (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

So, what happens if all the statistics are made up? Or you lose the ability to trust anything? Any photo, any video, voices on the phone, a Zoom face? You stop trusting. Then the world gets smaller again. Where is high trust? Face to face, hands get shaken, eyes get looked into and people once again do business with people. I think this will make people happier. The internet may be too big to thrive in. We’re social animals, we want to be around each other. We want face time, not Facetime. We want body language, not text messages. Maybe it’s time to be statistically out of the norm – time to be deviant. Hope you enjoy the story.

The Status of Limitations

The sculptor Arturo di Modica ran away from his home in Sicily to go study art in Florence. He later immigrated to the U.S., working as a mechanic and a hospital technician to support himself while he did his art. Eventually, he saved up enough to buy a dilapidated building in lower Manhattan, which he tore down so he could illegally build his own studio—including two sub-basements —by hand, becoming an underground artist in the literal sense. He refused to work with an art dealer until 2012, when he was in his 70s. His most famous work, the Charging Bull statue that now lives on Wall Street, was deposited there without permission or payment; it was originally impounded before public outcry caused the city to put it back. Di Modica didn’t mean it as an avatar of capitalism—the stock market had tanked in 1987, and he intended the bull to symbolize resilience and self-reliance:

My point was to show people that if you want to do something in a moment things are very bad, you can do it. You can do it by yourself. My point was that you must be strong.

Meanwhile, “Fearless Girl,” the statue of a girl standing defiantly with her hands on her hips that was installed in front of the bull in 2017, was commissioned by an investment company to promote a new index fund.

Who would live di Modica’s life now? Every step was inadvisable: don’t run away from home, don’t study art, definitely don’t study sculpture, don’t dig your own basement, don’t dump your art on the street! Even if someone was crazy enough to pull a di Modica today, who could? The art school would force you to return home to your parents, the real estate would be unaffordable, the city would shut you down.

The decline of deviance is mainly a good thing. Our lives have gotten longer, safer, healthier, and richer. But the rise of mass prosperity and disappearance of everyday dangers have also made trivial risks seem terrifying. So, as we tame every frontier of human life, we must find a way to keep the good kinds of weirdness alive. We need new institutions, new eddies and corners and tucked-away spaces where strange things can grow.

~ Adam Mastroianni