Before you criticize someone, you should walk a mile in their shoes. That way, when you criticize them, you’re a mile away and you have their shoes.

It’s weird out there, folks!

Perhaps you have felt it yourself, your emotions at war with your better nature. A surge of anger when you enter a store and forget your mask, or your job or kids’ school is pushed remote. It is a strange, uncertain time. Things feel broken. Companies keep postponing back-to-the-office dates. The Centers for Disease Control (the “other” CDC) keeps changing its rules. Political discord has calcified into political hatred. And when people have to meet in transactional settings – stores, airplanes, customer service calls – they are in a word – devolving! It seems that instead of saying, “That really inconvenienced me,” people have a shorter fuse and now shout, “What the hell is wrong with you?”

This isn’t the way I want to live and it is not the way I want to feel. I don’t mind masking up and keeping a respectable distance to protect others, but I don’t like the empty zombie feeling I get in public. I crave human contact and refuse to be afraid of others. What I miss is connection. Connections make us feel human! What’s more, real estate is about connections. Office, retail, even industrial property foster connection. In the last two years, our real estate has taught us to not connect (glass shield, spacing stickers, disinfection stations). It is time to start looking at planning for how your real estate will foster connections once again.

2022 could become an interesting year. Will inflation and the Fed’s laggardly response be too little too late? Will we see a continuation of a totally bifurcated and expanding war of opposing philosophies in Washington and to a lesser extent throughout the whole country? Will the midterm elections prove to be a sea change or continue on the current path? Will the Omicron variant of COVID-19 become just another common cold or will it morph into another devastating illness that cripples our economy and kills thousands more?

As we enter 2022, I think we may be entering the “Jenga Economy.” It’s that place where everything is building back up, but we are all guessing which one block if removed, will cause everything to come tumbling down. It is a crazy time, stocks, bonds, real estate, car prices, oil/gas prices are all at or near all-time highs. Economists all seem to be reporting a strengthening economy will deliver strong fundamentals in all areas including commercial real estate. I read a recent survey that said more millionaire investors think the economy will be stronger in 2022 than those who believe it will be weaker (CNBC Millionaire Survey). However, most surveyed found little appetite for more risk. What I can’t figure out is how they think things will go up if they don’t want to buy more.

I also recently read an interesting theory that 2022 will see slower demand for physical goods as the service sector reopens and attracts more spending. (If true, will it be enough to give the economy a haircut? – Sorry I couldn’t pass it up!)

As we seem to be heading into an inflationary environment, rent increases – CPI or fixed– are worth rethinking. I saw my first fixed 4% (instead of fixed 3%) last month. When I first started in the business (yes, a long time ago!) we had a minimum of 4% max 8% as the standard and as inflation came down, we moved to min 3% max 7%.

NICK’S NUMBERS

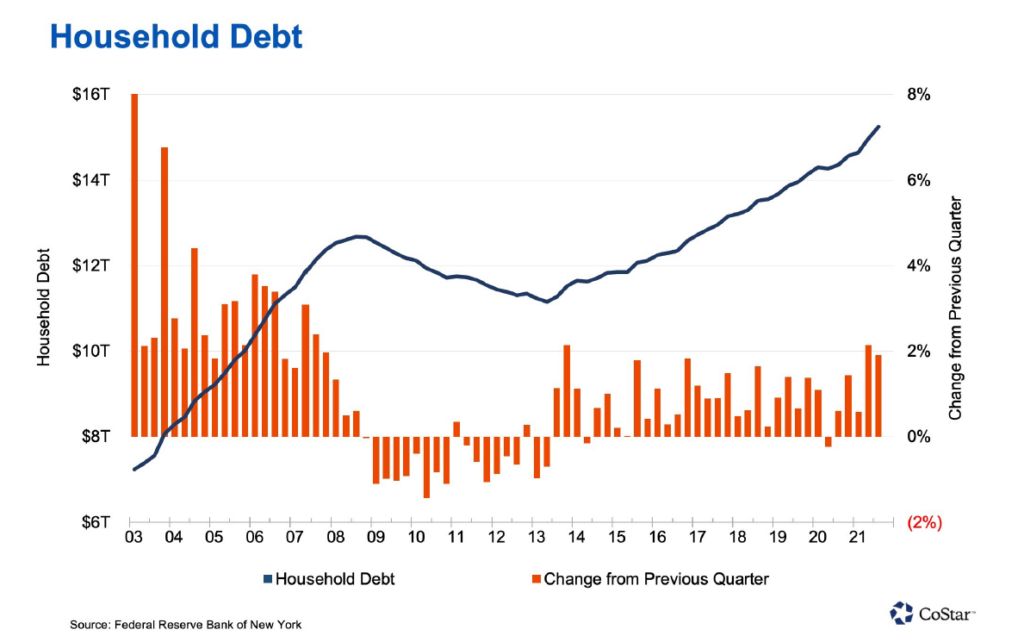

“There are negative aspects when you encourage people to borrow, but later feel that you can’t raise rates because so many people borrowed. That’s something of a trap.” ~ Howard Marks, Oak Tree Capital

I know for years my dad produced “The Gold Report” with market data and statistics about the CRE market. If you still like to pour over this kind of information, here are some links to the best annual reports out there:

PWC Emerging Trends in Real Estate

Please give me a call or email me if you would like an analysis of your properties’ value or to discuss what you should be doing with regards to the Coronavirus pandemic and its impacts on your business, tenants, or property (Nick Zech, 858-232-2100, nzech@cdccommercial.com).

Well, whether we are entering a “Jenga Economy” or an “Everything Bubble” or a post-COVID boom, I wish you all a healthy and prosperous New Year. Just know that with every new change in life, you can either mourn for the past and waste time, or you can look for new opportunities and take advantage of them as they appear. Also, know that into every life a little bit of Murphy’s Law will rain. Hope you enjoy the story…

Who’s Murphy Anyway?

Murphy’s law is commonly referenced, but have you ever wondered who Murphy is? There are different opinions on who coined the idiom associated with Murphy’s law. One of the most popular is attributed to Capt. Edward A. Murphy Jr. in 1949. Murphy was working as an aerospace engineer testing the effects of rapid deceleration on pilots at California’s Edwards Air Force Base. He monitored the pilots’ stress levels while they were strapped to a rocket-propelled sled. During one of the tests, the strain gauges failed to record any measurements. Murphy discovered that the electrodes had been wired backward and blamed it on one of his assistants back at Ohio’s Wright-Patterson Air Force Base. He remarked, “If there are two or more ways to do something, and one of these ways can result in a catastrophe, someone will do it.” Weeks later during a press conference, Air Force Col. John Paul Stapp used Murphy’s phrase and nicknamed it “Murphy’s Law.” The adage is now used by everyday Americans but has been simplified too, “If anything can go wrong, it will.”