Those who expect to reap the blessings of freedom must undergo the fatigues of supporting it.~Thomas Paine, September 11, 1777

Happy Heart Month! (note the double entendre!) Every year more than 600,000 Americans die from heart disease. It is the number one cause of death in most age groups. To put that in perspective, the total U.S. Covid death rate in the last 12 months was 410,000. In terms of having “Happy Hearts,” we didn’t fare any better. In fact, the U.S. dropped to 28th (out of 163) in the World Happiness Index.

Since the pandemic took hold in the U.S. in March of 2020, job loss has been one of the most significant consequences. Along with job losses, the GDP is estimated to have taken a hit of $7.6 trillion! Unemployment, uncertainty, lost loved ones, and lost social connections, have led to spikes in depression and anxiety. In a recent survey, 40% of U.S. adults reported having at least one mental illness. Based on the sheer number of people struggling, the cost of mental health impairment could be as high as $1.6 trillion.

Although human life is priceless, insurance companies and lawyers, and politicians have a notion called “statistical lives” which assigns a value of $7-10 million per life. Armed with this metric, the cost of premature death by COVID is over $5 trillion. Another $2.5 trillion for the lifelong impairments like respiratory and cardiovascular issues.

When you add up the lost GDP ($7.6T), premature deaths ($5T), health impairment ($2.6T), and mental health impairment ($1.6T) you get a WHOPPING $16.8 Trillion! This is a stunning number, especially when you compare it to all the fiscal spending on all wars since 9-11 – $6 trillion.

But we are getting a shot in the arm (pardon the pun!). Vaccines are rolling out along with stimulus checks. However, I think that once the vaccine and stimulus and forbearance (evictions, foreclosures, etc.) wave finishes and the tide goes back out we are going to find out who doesn’t have a bathing suit on anymore! I told a lender the other day, “The king has no clothes, and I am just waiting for someone to tell him.”

Most of what I am reading is saying that there is cautious hope. The virus will be tamed. The GDP will grow at 5.5%, interest rates will stay unchanged and monetary policy will remain stimulative and the dollar is expected to weaken. On the other hand, my job is to spot and anticipate bubbles and I see four of them currently with us.

- House Prices – pandemic-driven boom, fueled by artificially low-interest rates.

- Stock Prices – the Dow is overvalued based on Dow’s historical low dividend yield to value.

- BitCoin – $30,000+ for a unique number. . . please refer to Tulip mania in Holland in 1637.

- Cost of College Education – $100K – $500K for watching Zoom/YouTube. The only thing you get when you go back is beer and football. Please refer to – the king has no clothes.

Of course, if I knew how and when these bubbles might burst, I wouldn’t be spending my Saturday afternoon writing this letter. However, these are where I would start:

- COVID is not going away.

- New President – new issues/problems/decisions.

- Lifting of a foreclosure moratorium. – in 2008 $7 million lost homes to foreclosure. I think we will double that when the moratorium is lifted.

- Lifting of evictions moratorium 25% of renters in the US are not behind in payments. That is 10 mil renters and 57.3B behind!

- Bond market – will the bond market try to reign in the staggering amount of debt on the books. I have a client who said, we are one interest rate hike away from a bubble pop.

- China – so goes Hong Kong so goes the U.S.

Hopefully, we will reach herd immunity soon. Just watch out to not get caught in the herd mentality!

Below is a link to a very informative Economic Forecast. Alan Nevin is one of the top economists for the San Diego region. 2021 Economic Forecast by Alan Nevin.

Nick’s Numbers

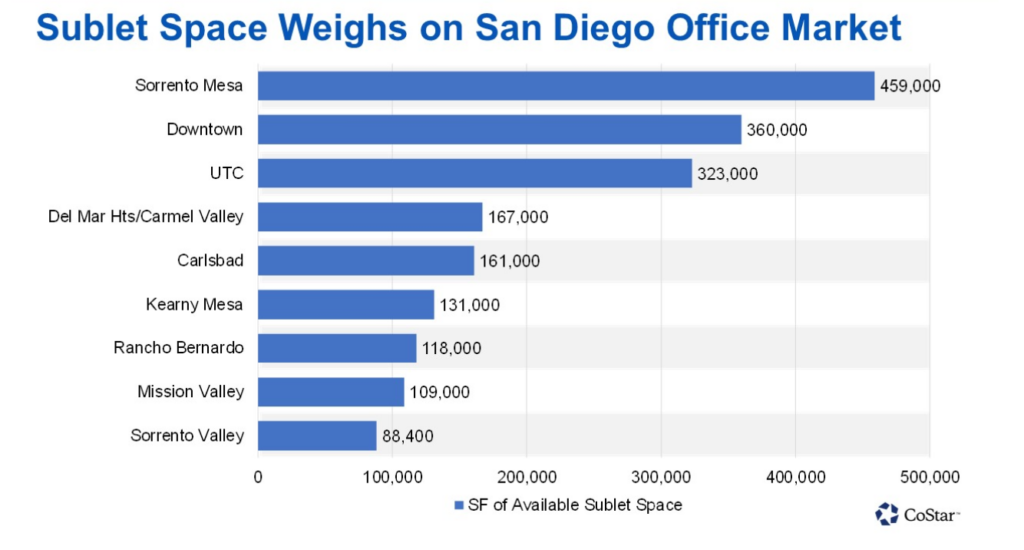

This month’s chart is courtesy of Costar and shows the retail vacancy rate rising from the continuation of the predicted fallout of tenants. If you would like to talk about your vacancy of struggling tenant(s), give me a call or drop me an email.

Please give me a call or email me if you would like an analysis of your properties’ value or to discuss what you should be doing with regards to the Coronavirus pandemic and its impacts on your business, tenants, or property (Nick Zech, 858-232-2100, nzech@cdccommercial.com).

Commercial real estate powerhouse CBRE recently announced its move from Los Angeles to Dallas. It was funny to me because they started as Coldwell Banker which was owned by Sears. Sears spun them off in 1989. Today, they have 100,000 employees, $16.4 billion in market capitalization, and are in the Fortune 500. Meanwhile, Sears is ….

You may or may not have heard about AB802 which requires you to disclose your commercial property energy usage (benchmarking) by June 1 or get an exemption by March 1st. As I understand it, it is still only for buildings 50K square feet or larger, but I am guessing that this will trend smaller in time. Here are links to the San Diego site and a webinar you might want to watch.

I wish you all a heartfelt Happy Valentines Day and if you think it’s bad that Big Tech is censoring people at least you can still mail racy Valentine’s cards. I hope you enjoy the story…

During the late 1800s, postage rates around the world dropped, and the obscene St. Valentine’s Day card became popular, despite the Victorian era being otherwise very prudish.

As the number of racy valentines grew, several countries banned the practice of exchanging Valentine’s Day cards.

During this period, Chicago’s post office rejected more than 25,000 cards on the grounds that they were so indecent, they were not fit to be carried through the U.S. mail.