The first Thanksgiving celebration lasted three days. Today, Plymouth Rock is only the size of a car engine. It has cracked three times over the years, getting smaller each time.

Speaking of rocks, Nick lost his grandmother and I, my mother, a couple of weeks ago. At 87, she had lived a good life. She was my rock and her strong Scottish roots (yes, she was a legal immigrant, and I guess I qualify as a first-generation American) taught me how to pull myself up by my bootstraps. Of course, now I wonder, what the heck are bootstraps, and how could you possibly use them to pull yourself up?

Speaking of bootstraps, before the government shutdown, government jobs fell by 16,000 in August. The government shed more than 97,000 jobs since February. We’ll see more because of the shutdown and because many took deferred resignations earlier in the year and will leave the workforce in October/November. However, here is the bootstrap allusion, there was an increase in self-employment!

The number of self-employed workers increased by 304,000 while overall employment grew by 288,000, suggesting that workers who lost payroll jobs in recent months have moved into self-employment. Can you say Gig Jobs!

On October 16, something unusual happened at the Fed. Normally, banks pledge Treasuries to the Fed (through the repo window). This was the problem with the First Republic collapse in May 2023. The banks learned that their 1% Treasuries were worth half as much at 2% interest rates. At that time, the Fed told all the banks they would accept their pledge of Treasuries at face value, not market value, which staved off a major banking crisis. However, on October 16, the banks pledged almost 80% mortgage-backed securities instead of Treasuries. And like Treasuries in 2023, lots of these mortgages are not worth their face value. When one borrower defaults, everyone starts wondering who’s next as they wait for the other boot to fall. That’s why, later that day, the Fed announced a nearly half a trillion dollars of emergency overnight liquidity. What do they know, or who do they know, is in trouble?

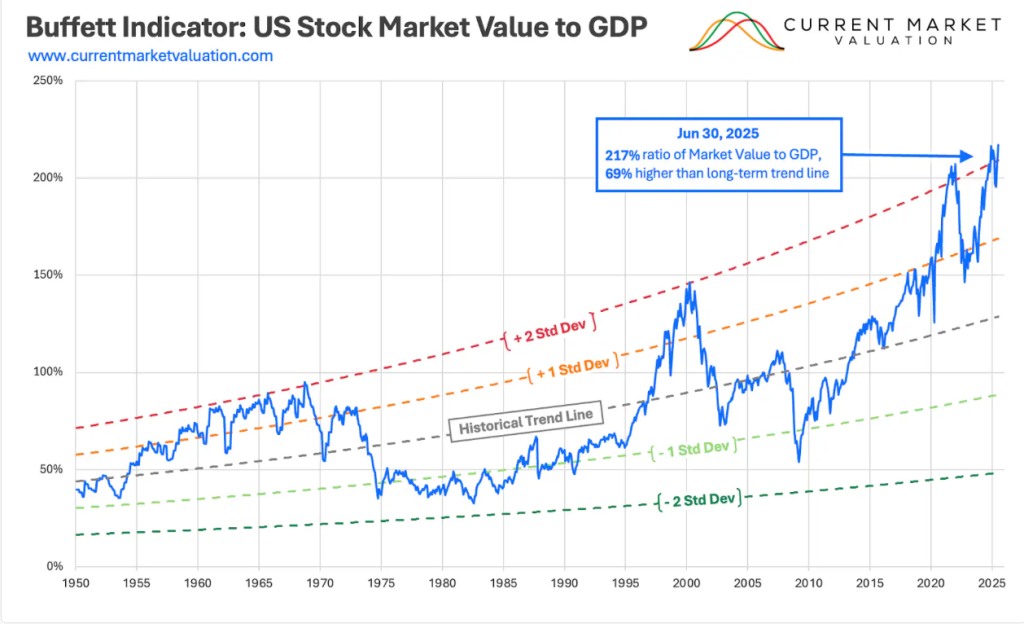

Meantime, the stock market keeps its boots on and marching forward. I’ll let Nick show you an interesting chart about fair value (which is what we try to look for in all assets, especially commercial real estate).

Nick’s Numbers

The Buffett Indicator (or Buffett Index or Buffett Ratio) is the ratio of the total U.S. Stock market to GDP. As of October 21, 2025, current market cap is $67.42T and current GDP is $30.49T for an index of 221.18%. This ratio fluctuates over time since the stock market is volatile, but GDP tends to grow more predictably. However, the current ratio is more than two standard deviations above the historical trend suggesting the market is strongly overvalued. To say it a different way, if the stock market is growing faster than the actual economy, then it may be a bubble.

If you would like an analysis of your property’s value or discuss what you should be doing with regard to interest rates or inflation and their impacts on your business, tenants, or property, I’d be happy to talk. (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

Lest you think I am all doom and gloom, let me tell you I do not think there will be a formal default on U.S. Treasury debt or anything like it. The easiest way to default is simple inflation. Even 4% inflation will cut the value of the dollar in half in just 18 years, and half again in another 18 years (And that is the Feds target goal!). That means the dollar will lose more than 75% of its purchasing power in a typical 40-year career, beginning at age 23 and retiring at age 63. Inflation higher than 4% will decimate the dollar even faster. The simplest form of protection is to allocate half of your portfolio to hard assets like real estate, gold, silver, or other natural resources.

I read somewhere that bubbles are based on an old belief and a bubble is something that everyone agreed on…until they didn’t .

Between my mom’s passing, her disdain for bureaucracy, and her wry British sense of humor, I thought this was an appropriate story for this month’s letter. Hope you enjoy it…

Below is what is said to be an actual letter that was sent to a bank by an 87-year-old woman. The bank manager thought it was amusing enough to have it published in The New York Times.

Dear Sir,

I am writing to thank you for bouncing my check with which I endeavored to pay my plumber last month.

By my calculations, three nanoseconds must have elapsed between his presenting the check and the arrival in my account of the funds needed to honor it. I refer, of course, to the automatic monthly deposit of my entire pension, an arrangement which, I admit, has been in place for only eight years. You are to be commended for seizing that brief window of opportunity, and also for debiting my account $30 by way of penalty for the inconvenience caused to your bank. My thankfulness springs from the manner in which this incident has caused me to rethink my errant financial ways.

I noticed that whereas I personally answer your telephone calls and letters, when I try to contact you, I am confronted by the impersonal, overcharging, prerecorded, faceless entity which your bank has become.

From now on, I, like you, choose only to deal with a flesh-and-blood person. My mortgage and loan repayments will, therefore, and hereafter, no longer be automatic, but will arrive at your bank by check, addressed personally and confidentially to an employee at your bank whom you must nominate.

Be aware that it is an offense under the Postal Act for any other person to open such an envelope. Please find attached an Application Contract which I require your chosen employee to complete. I am sorry it runs to eight pages, but in order that I know as much about him or her as your bank knows about me, there is no alternative. Please note that all copies of his or her medical history must be countersigned by a Notary Public, and the mandatory details of his or her financial situation (income, debts, assets, and liabilities) must be accompanied by documented proof. In due course, at MY convenience, I will issue your employee with a PIN number which he or she must quote in dealing with me. I regret that it cannot be shorter than 28 digits, but, again, I have modeled it on the number of button presses required of me to access my account balance on your phone bank service. As they say, imitation is the sincerest form of flattery.

May I wish you a happy, if ever so slightly less prosperous New Year?

Your Humble Client

Remember, this was written by an 87-year-old woman. Remember, too: don’t make old women mad. They don’t like being old in the first place, so it doesn’t take much to set them off.