“Good judgement comes from bad experience…and most of that comes from bad judgement.”

As I have written before, uncertainty is a killer of markets. When investors or business owners have a murky view of the future – reluctance to make commitments abounds. For the last decade, we have lived in a FOMO (Fear of Missing Out) society. It has driven stocks and real estate higher and higher. I am now warning that we are entering a time of FOL (pronounced Fall) or Fear of Losing. Nossin Taleb said, “It takes five years to learn how to make money…and twenty-five to learn how not to lose it.” So successful real estate investment comes down to using your capital in such a way that its spending power is not only preserved but increased over time – in the form of cash flow or capital gains or both.

As I have written before, uncertainty is a killer of markets. When investors or business owners have a murky view of the future – reluctance to make commitments abounds. For the last decade, we have lived in a FOMO (Fear of Missing Out) society. It has driven stocks and real estate higher and higher. I am now warning that we are entering a time of FOL (pronounced Fall) or Fear of Losing. Nossin Taleb said, “It takes five years to learn how to make money…and twenty-five to learn how not to lose it.” So successful real estate investment comes down to using your capital in such a way that its spending power is not only preserved but increased over time – in the form of cash flow or capital gains or both.

The end of 2022 couldn’t have come soon enough for many. Sputtering capital markets, job cuts, raging inflation, the crypto meltdown and rising interest rates marked a year of upheaval. I think the odds are high for a recession in 2023 with an unlikely recovery until 2024 or even 2025. Forecasts suggest that we could see a big drop in real estate values ahead. Bayes Business School in London indicated that values need to fall 25% to 30% to match today’s lending realities of tighter underwriting and higher costs. As a result, many borrowers may need to pump in additional cash to successfully refinance their loans coming up in 2023 and 2024.

Before declaring victory on inflation, the Fed will need to be convinced not only that inflation has settled near the 2% target but also that the inflationary psychology has been extinguished (and that comes with some pain). To accomplish this, the Fed will likely want to see a positive real Fed funds rate – at present it’s minus about 2.2% (4.5% Fed rate minus 6.7% inflation).

I am currently reading, The Price of Time (The Real Story of Interest), so far it is very interesting. However, I noted that some things never change. The 1700’s Scottish economist (Wealth of Nations) stated, “When money is dear land is cheap and when land is expensive money is cheap.”

On a positive note, we are adding a new teammate at CDC Commercial. Pete Orth (yes, Matt’s dad) will be joining us after spending decades at CBRE and Colliers. He’s completed over $600 million in transactions in his career. We look forward to having Pete on the team and in the family.

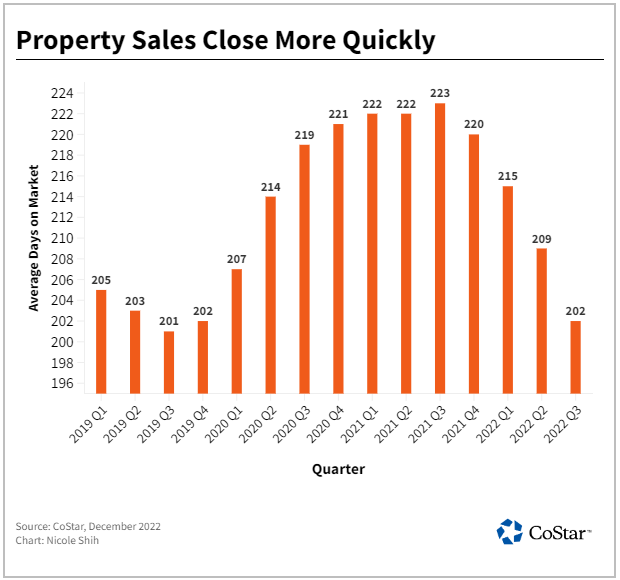

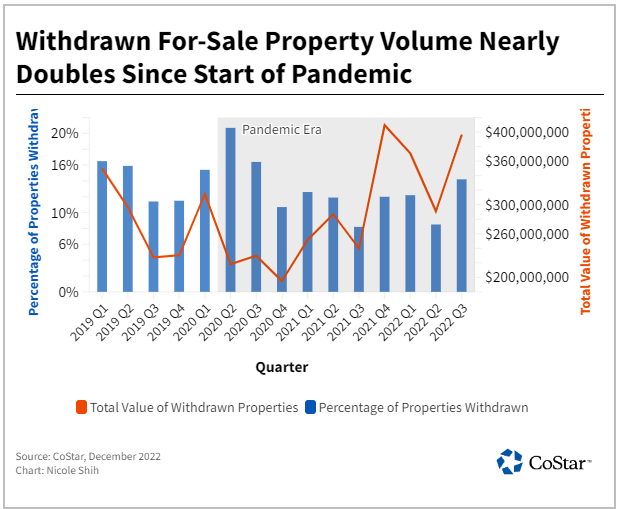

As another example of this crazy market, we have seen sellers reassessing the market and taking properties off the market. However, at the same time, the average number of days on the market has fallen for the fourth consecutive quarter. Now averaging 202 days on market. This is generally a good sign and an indicator that sellers are getting their price.

Nick’s Numbers

Here are two charts that support what Don is saying above. All I know is that we are off to a quick start with a number of closings scheduled for the first month of the year! (Those are my kind of numbers!).

Please give me a call or email me if you would like an analysis of your properties’ value or discuss what you should be doing with regards to interest rates or inflation and their impacts on your business, tenants, or property (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

Well I had a life changing experience this month and it is one that all of you are likely to start seeing and having in the years ahead. I am reminded of when I first downloaded a web browser that a couple of undergrads at Stanford had put out there called “Google” (only wish I had bought stock in it back then!). This month I played a little with ChatGPT (https://chat.openai.com/chat). Let me tell you this is not the little pop up for customer service on a web page. ChatGPT is likely to change the way we search the internet but it is also likely to eliminate jobs or at least enhance our productivity by automating tasks and redeploying humans for more strategic functions. You will need to try it yourself to experience the potential power but my examples were as follows; I asked it to create a commercial lease for 1000 SF for five years with 3% annual increases. I gave it the property address and landlord and tenant name. In less than 30 seconds it provided me a two-page lease.Now it is not the 20-30 page lease that we typically use but – VERY impressive. For my second inquiry I asked it to give me a blog post of the current condition of the San Diego Commercial real estate market and below is what it provided, also, in less than 30 seconds.

The commercial real estate market in San Diego has remained strong despite the challenges posed by the COVID-19 pandemic. In fact, the market has remained relatively stable thanks to a diverse economy, a well-educated workforce, and a desirable location.

One of the biggest trends in the San Diego commercial real estate market is the continued demand for office space. The region has a thriving tech industry, which has helped to drive demand for office space in areas such as downtown San Diego and the Sorrento Mesa neighborhood.

However, the pandemic has also led to a shift towards remote work, which has resulted in some companies reducing their office space needs. This has caused some landlords to offer flexible lease terms and other incentives in order to attract tenants.

The retail real estate market in San Diego has also been affected by the pandemic, as many stores were forced to close or operate at reduced capacity. However, the market has started to bounce back as more people have been vaccinated and restrictions have been lifted.

There has been strong demand for industrial real estate in San Diego, particularly for warehouses and distribution centers. The region’s proximity to the U.S.-Mexico border and its strong transportation infrastructure make it an attractive location for logistics companies.

Overall, the commercial real estate market in San Diego remains strong and is well-positioned for the future. The region’s diverse economy and desirable location will continue to attract businesses and investors, helping to drive demand for commercial real estate.

I have to say during this holiday period I have seen an extraordinary number of people venting their anger whether in the stores or on the road. It seems our collective anger or frustration level is just bubbling below the surface. My wish for everyone in the new year is that we can bring that simmer down to room temperature and enjoy the year ahead. I hope you enjoy the story…

Two cars were waiting at a stop light. The light turned green, but the man in the front car didn’t notice. The woman in the car behind him starts pounding on her steering wheel and yelling for the man to move. The man doesn’t move, and the woman goes ballistic inside her car… ranting and raving, pounding on her steering wheel and dash.

The light then turns yellow, and the woman blows her horn longer, gesturing with one finger and screaming curses at the man. The man, upon hearing the commotion, looks up… sees the yellow light… and accelerates through the intersection as the light turns red.

By now the woman is beside herself, screaming in frustration having missed her chance to pass through the intersection. As she is in mid-rant, she hears a tap on her window and turns to look into the barrel of a gun held by a very serious looking policeman.

He tells her to shut off her car while keeping both hands in sight. She complies, speechless at what is happening. After shutting the engine, the policeman orders her to exit the car with her hands up. She gets out, and at his orders, turns and places her hands on her car roof, upon which the officer quickly handcuffs and hustles her into the patrol car.

Too bewildered by this chain of events to ask any questions, she is driven to the police station where she is fingerprinted, searched, booked, and placed in a cell. After a few hours, a policeman approaches the cell and opens the door for her. He escorts her back to the booking desk where the original officer is waiting with her personal belongings. After returning them to her he says, “I’m really sorry for this mistake, but you see, I pulled up behind your car as you were blowing your horn, gesturing with your finger and cussing a blue streak at the car in front of you.

And when I noticed the “What Would Jesus Do” and “Follow Me to Sunday School” bumper stickers, the “Choose Life” license plate holder and the chrome-plated Christian fish emblem on the trunk, I naturally assumed you’d stolen the car.