They used to use urine to tan animal skins, so families used to all pee in a pot, and then once a day it was taken and sold to the tannery. If you had to do this to survive you were “piss poor.”

But worse than that were the really poor folk who couldn’t even afford to buy a pot. They “didn’t have a pot to pee in” and were the lowest of the low.

Historically, when the Fed begins to consistently increase its benchmark interest rate, a recession follows 18-36 months behind.

Thus, even as the job losses of 2020 have yet to be fully recovered, the economy is heading for a second recession.

The average interest rate has increased such that the amount of mortgage money available to a typical investor has fallen nearly 25% from December 2020. Absent other changes in circumstance – say, income increases or sudden cash windfalls – investors today are at a major disadvantage compared to just a year ago. Rate increases will lead to reduced demand for properties – and while the drag on prices is not yet perceptible in mid-2022, the decline is imminent.

The irony is that the Fed has been charged to fight the very problem it has helped to create. But, you have to thank them for the best recovery that $6 trillion could buy! Now, the Fed must prove it can control inflation at any and all costs. Maybe it is the old guy in me, but I am a bit worried about the “born in a bull market” generation who have not ever seen a real recession in their adult working life. I am afraid they are confusing brains with a bull market when it comes to their future expectations.

Ultimately, it comes down to knowing the difference between trading, speculating and investing. If you are trading, you value the property, the cost of adding value (construction, re-tenanting, raising rent, etc.) and what you can resell for (you know your profit going in). If you are speculating (buying and assuming it will go up) – stop or get out now. If you are investing, know what your free cash flow is – that’s after inflated expenses and higher debt service. What is your cash return on your cash investment?

On the good news front, unemployment nationally is at 3.5% and in San Diego at an all-time low of 3%. This bodes well for occupancy and rents, but it also emboldens the Fed to keep pumping up rates until unemployment rises.

Inflation is the #1 concern amongst small business owners There is a lot of controversy around the government’s inflation index. The Fed has an incentive to report low numbers. However, it is a bit like the fox guarding the chickens because they are also in charge of what items are in the basket of goods and what they report. If we were to calculate using methods used in the ‘80s and ‘90s, the official inflation rate would be 14% and 10%, respectively. To extrapolate this further, the natural borrowing rate for a loan should be about 3% over the inflation rate. That puts us at projected double-digit borrowing rates! Let me just tell you that if this chicken got out of the hen house and interest rates and cap rates rose to double digits, we’ll all be looking for a pot to pee in!

As we continue to hear about inflation shooting to the moon or outer space, I reflected on the current billionaire-fueled race to space. It is interesting to see that it is now extending to space lodging and orbiting business parks. Fontana-based Orbital Assembly Corp is touting plans for “the first commercially viable, space-based business park with gravity.” Let it be known, that I have volunteered to be the first on-site leasing agent!

Nick’s Numbers

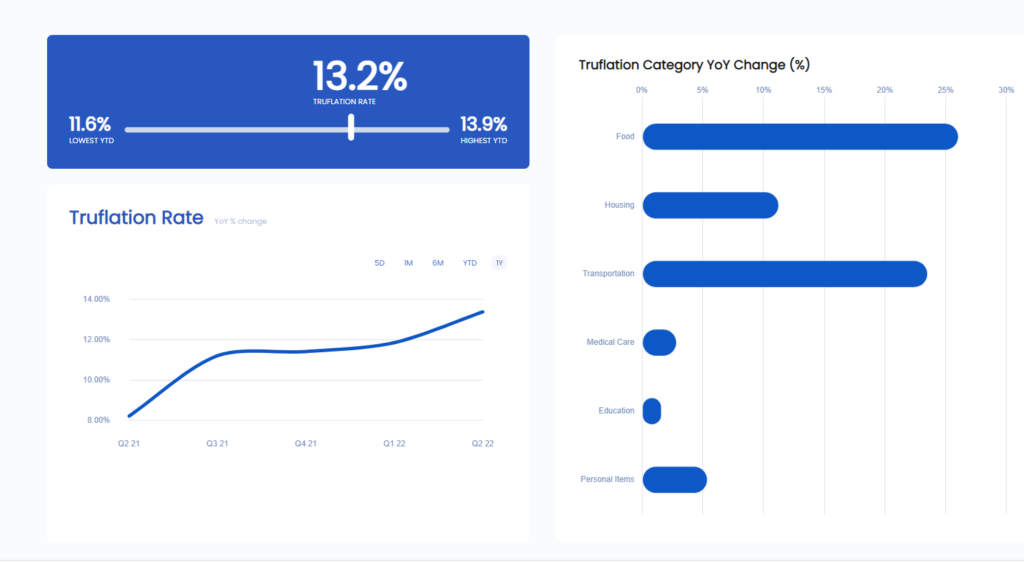

While the Truflation index is based on the same calculation model as the widely used CPI, it is different because it uses real-market price data like Zillow, Penn State, and Nielsen. So where does that leave us with the “real” inflation rate?

Please give me a call or email me if you would like an analysis of your properties’ value or discuss what you should be doing with regards to interest rates or inflation and their impacts on your business, tenants, or property (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

Always keeping my eyes open for new economic indexes, I recently found an interesting one. It’s called the “Men’s Underwear Index.” Since men’s underpants are one of the last pieces of clothing that men look to buy, it’s a good indicator of when times are hard. Apparently, sales of men’s underwear are quite consistent, but dips in sales indicate that men’s finances are so stretched that they decide to hold off on buying replacements (Gives new meaning to the phrase, “Hang onto your shorts!”)

Like many things, inflation, recessions, and good times are all part of our perceived reality…I hope you enjoy the story…

Pennies from Heaven by Julie Bain

My dad loved pennies, especially those with the elegant stalk of wheat curving around each side of the ONE CENT on the back. Those were the pennies he grew up within Iowa during the Depression, and Lord knows he didn’t have many.

When I was a kid, Dad and I would go for long walks together. He was an athletic six-foot-four, and I had to trot to keep up with him. Sometimes we’d spy coins along the way – a penny here, a dime there. Whenever I picked up a penny, he’d ask, “Is it a wheat?” It always thrilled him when we found one of those special coins produced between 1909 and 1958, the year of my birth. On one of these walks, he told me he often dreamed of finding coins. I was amazed. “I always have that dream, too!” I told him. It was our secret connection.

Dad died in 2002. By then, I was living in New York City which can be exciting, or cold and heartless. One gray winter day, not long after his death, I was walking down Fifth Avenue, feeling bereft, and I glanced up and found myself in front of the First Presbyterian Church, one of the oldest churches in Manhattan. When I was a child, Dad had been a Presbyterian deacon, but I hadn’t attended in a long time. I decided to go.

Sunday morning, I was greeted warmly and ushered to a seat in the soaring old sanctuary. I opened the program and saw that the first hymn was “A Mighty Fortress Is Our God,” Dad’s favorite, one we’d sung at his funeral. When the organ and choir began, I burst into tears.

After the service, I walked out the front doors, shook the pastor’s hand, stepped onto the sidewalk—and there was a penny. I stopped to pick it up, turned it over, and sure enough, it was a wheat 1944, a year my father was serving on a ship in the South Pacific.

That started it. Suddenly wheat pennies began turning up on the sidewalks of New York everywhere. I got most of the important years: his birth year, my mom’s birth year, the year his mother died, the year he graduated from college, the war years, the year he met my mom, the year they got married, the year my sister was born. But alas, no 1958 wheat penny—my year, the last year they were made.

Meanwhile, I attended church pretty regularly, and along toward Christmas a year later, I decided I ought to join. The next Sunday, after the service. I was walking up Fifth Avenue and spotted a penny in the middle of an intersection. Oh, no way. I thought. It was a busy street; cabs were speeding by–should I risk it? I just had to get it.

A wheat! But the penny was worn, and I couldn’t read the date. When I got home, I took out my magnifying glass and tilted the copper surface to the light. There was my birth year.

As a journalist, I’m in a profession where skepticism is a necessary and honest virtue. But I found 21 wheat pennies on the streets of Manhattan in the year after my father died, and I don’t think that’s a coincidence.