It seems that Jeff Bezos has experienced the same problem as many Amazon customers with having Echo ordering inappropriately:

Scene: Amazon’s Jeff Bezos’ trendy home earlier this month. He’s talking to his Echo.

Bezos: “Find me something to buy at Whole Foods.”

Echo: “Okay, buying Whole Foods.”

Bezos: “Oops.”

Amazon is killing a lot of businesses. In the process, it may also be killing inflation – they are squeezing prices of everything through their automation and efficiencies. Both factors that are bound to hurt commercial real estate. Although all of the focus this month has been on the Whole Foods purchase (never mind that Whole Foods has less than 3% of the grocery market), I think the breaking news was the roll out of Amazon Prime Wardrobe. Here the online retailer attacks the biggest problems of buying clothes; (1) the time it takes to shop, (2) the hassle of finding the right size, (3) returning stuff you don’t want (comes with pre-labeled return but you get a discount if you keep it all).

As we enter the second half of the year, I would like to take an assessment of where we stand and share some interesting data that I am seeing. First, I will tell you that we continue to be busy and are not experiencing any slowdown. Interest rate bumps have not affected most of our day to day investor/buyers. However, the think tanks and big data are pointing to a “slow-motion slow-down.” Low unemployment is generally good for commercial real estate (more workers – more space).

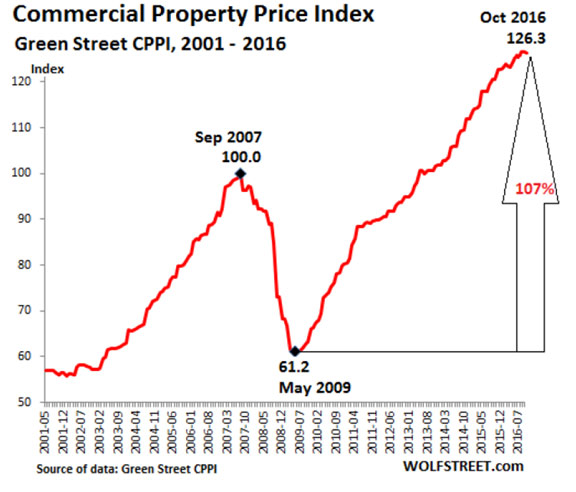

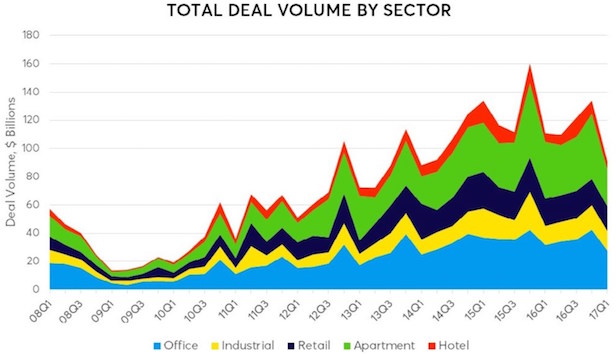

However, too low makes it tough to expand without a pool of workers. Slowing job growth may be the catalyst for the slowdown. E-commerce will continue to bring retail to its knees. Interest rates will continue to tick up which will put upward pressure on cap rates (and lower prices). With cap rates at record lows (I saw a 3.5% cap on a property in NYC!) it is hard to believe that there is much room for commercial real estate prices to run.

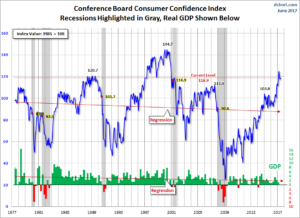

A couple of charts below help to illustrate my concerns.

If you really like charts, numbers and big data then you will really enjoy the Cycle Monitor by Dividend Capital Research and Glenn Mueller, PHD.

While recessions are inevitable, it will not be anywhere near the disaster of 2008 (and we probably won’t start seeing the “slow-motion, slow-down” until 2018). Rather we will more likely see a prolonged flat period. The recession of 2007-2009 was the closest thing to the great depression. My guess is the next recession will be more modest. Commercial real estate has nowhere near the excesses that were built up in the mid 2000’s. In the meantime, low unemployment, low cap rates, low vacancy rates, head down, work hard and enjoy the ride. Hope you enjoy the story…

Jeff Bezo’s Email to Employees on Amazon’s Purchase of Whole Foods

by Ryan Garcia

Team;

Today is a significant milestone in the evolution of the Amazon brand. Our offer to purchase Whole Foods will finally consolidate the largest online and off-line retailers where consumers end up spending way more than they intended. I actually didn’t even mean to buy Whole Foods but after downing a few too many boilermakers at the Echo mixer last night, I accidentally clicked BUY IT NOW instead of just putting the grocery chain in my cart for future consideration.

Oh well, you know what they say-you can’t log off Amazon without spending $13.7 billion. So true!

Further details about the merger will be forthcoming, but I wanted to call out a few major points before we have to go silent and get this approved by regulators.

- Our corporate cultures or perfectly aligned. The New York Times revealed that every Amazon employee has cried at their desk, and I personally made a Whole Foods employee cry when they couldn’t correctly identify their process for ensuring single-source coffee beans throughout the roasting process. It was an uncomfortable 38 minutes for both of us, but I think an experience so many of you can relate to.

- Improved Echo functionality. Whole Foods has maintained a laser-like focus on organic foods and sustainable facilities and I’m excited to bring that same vision to Echo. Starting next week, when customers ask their Echo to order non-organic food products that receive a 12-minute lecture on the benefits of organic and local source products while our top-notch product matching software will send them the closest available organic item. Users on our website will find the “Customers Also Bought…” section replacing unhealthy items with notes such as, “Cookies That Went Straight to Their Thighs” and “Beef Produced By Clearcutting Rain Forest.” Needless to say, those products will not be available for purchase.

- Drone changes. All Amazon drone teams will immediately switch to bio-fuels rather than battery packs.

- Senior leadership. Once the acquisition is complete, John Mackey will take a new position as financial analyst and social media community outreach for the Washington Post. Synergy!

- Location changes. Since Whole Foods is headquartered in Austin, Texas, I’ve asked EM to build the first hyperloop route between our offices here in Seattle and the Blue Bubble of Texas. All Amazon/Whole Foods employees Will office in Austin for the one week of good weather they have in late February, and in Seattle for the one week of sunshine we have an August (or May… or October… or whenever). The remaining 50 weeks of the year are up to you. Because I believe all Amazon employees should be free to cry at their desk no matter where that desk is located.

- Product expansions. Amazon will soon carry all of the 365-branded products Whole Foods has developed in all Whole Foods stores we’ll be adding aisles for garden equipment, household electronics, sportswear, handbags, pet supplies, golf clubs, video games, plumbing supplies, luggage, headphones, and climbing gear. To start.

- Cruelty free. We will be adopting Whole Foods policy of only purchasing products that are certified cruelty free. Please note this does not apply to any software we developed ourselves.

I am beyond excited by the possibilities of this merger moving forward and I hope the team feels the same. The combination of our two companies will account for over 85% of all hipster purchases in the United States. I’m looking forward to capturing the remaining 15%.

Now, I need your daily status updates and you aren’t excused for being late for reading this.