What a whirlwind! My daughter, who has been dating a very nice young man for the last five years, asked us to go on a family trip to Vancouver at the beginning of the month. The night we got there they surprised all of us by announcing they were getting married the next day! She had brought two wedding dresses (bought on Amazon) and had the mothers say yes to the dress that night. We went on a seven-mile hike the next day, got changed at a nearby campground, walked to the edge of a fairy tale mountain lake where a minister appeared (because they had given him a Geo pin to locate the site). It’s no longer retail that is being revolutionized by technology even the institution of marriage is changing (who gets China and Silver and Crystal anymore?). Today, 40% of couples now meet online (my daughter, of course, met her husband sky diving!).

What a whirlwind! My daughter, who has been dating a very nice young man for the last five years, asked us to go on a family trip to Vancouver at the beginning of the month. The night we got there they surprised all of us by announcing they were getting married the next day! She had brought two wedding dresses (bought on Amazon) and had the mothers say yes to the dress that night. We went on a seven-mile hike the next day, got changed at a nearby campground, walked to the edge of a fairy tale mountain lake where a minister appeared (because they had given him a Geo pin to locate the site). It’s no longer retail that is being revolutionized by technology even the institution of marriage is changing (who gets China and Silver and Crystal anymore?). Today, 40% of couples now meet online (my daughter, of course, met her husband sky diving!).

Upon getting back from the whirlwind weekend, I promptly had a birthday and ran a duathlon the next day. For the first time I was first in my division (yes, you guessed it – I was the only one in my age group!) The field seems to be getting younger and younger – it couldn’t be me getting older!

Flummoxed – def. completely unable to understand. Utterly confused or perplexed.

Yes, that is my word for the month and completely describes my position on politics, the economy, and the real estate market. Unemployment low? Check! Interest rates low? Check! Earning up? Check! What could possibly go wrong/

I think the process we may be in the midst of is a change of cycle where Central Banks and governments are unlikely to be able to disguise their actions, because both monetary tools and fiscal policy have been exhausted (remember the story – the King has no clothes? Somebody has to tell them they have no money!). This change of cycle may not bring a recession but instead, a Japanese style stagnation as debt continues to rise while economic and productivity growth weaken. Pay attention – liquidity if falling.

Here is what we are seeing up close and personal in the market. Are we busy? Check! Are people looking at space to lease or investments to buy? Check! Are we seeing multiple offers in some cases? Check. Are we making money? Not sure yet??? Everyone seems to want their deal done yesterday but when push comes to shove there seems to always be a reason to push things out until tomorrow. So, if we don’t close all that we have been carrying over and collecting for the last six months it could be a catastrophe. If we close most everything, we are working on it will be one of our best years.

Flummoxed!

Another flashing light – U.S. mortgage debt hit a record this month, eclipsing the 2008 peak. With the latest rate cut, just watch those ATM machines dispense money again. Despite low rates and high debt levels, housing starts fell almost 1% in June (single-family up 3.5%; multi-family down 9.2%). I don’t think the housing market will be the primary cause of our next economic collapse, but it could be part of the bursting of an everything bubble – retail apocalypse, trade war, bond bubble, the credit bubble, and student loan bubble. More than 45 million U.S. borrowers owe $1.7 trillion in student loan debt – more than auto loans and credit card debt combined!

Nick’s Numbers:

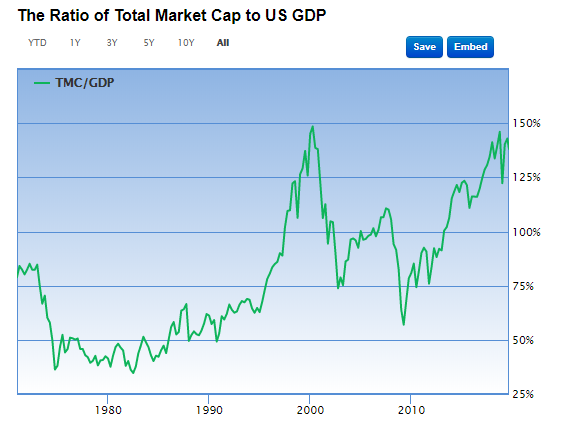

Hi all, this month I would like to share two interesting views. First a very interesting chart of the Total Market cap of all stocks to the US GDP. You really don’t want to see it over 100% and certainly not trying to breach 150%. The last time it did so was 2008. It is often called the Buffett Indicator because it is said that he uses this tool to measure the markets value.

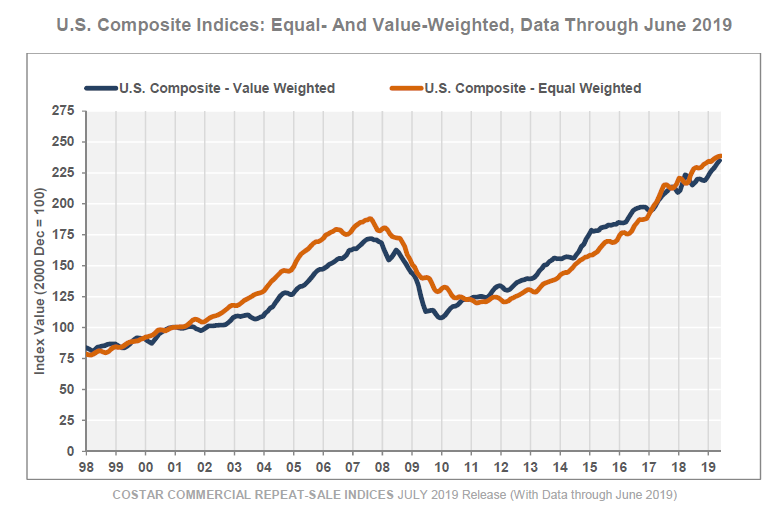

The second is the CoStar Composite Price Indices released in July. It is based upon more than 212,000 repeat sales since 1996. The CCRSI offers the broadest measure of commercial real estate repeat sales activity. Industrial led and Retail lagged but all ships were rising in this economy.

Please give me a call or email me if you would like more in depth info (like a property valuation or analysis). Nick Zech, 858.232.2100, nzech@cdccommercial.com ). ~ Nick

Well by the time you are reading this, I will have celebrated my 33rd wedding anniversary. My now married daughter will be massively in debt as she goes off to law school and I will be running a marathon in France (my fourth Continent in my quest to run a marathon on all seven continents). The whirlwind continues and I remain Flummoxed —or as my favorite running bumper sticker says “26.2 miles… what could possibly go wrong?” Hope you enjoy the story…

Daughter: Daddy, I am coming home to get married. Take out your checkbook. Dad, I’m in love with a boy who lives far away from me. I am in Australia and he lives in the UK. We met on a dating website, became friends on Facebook, had long chats on WhatsApp, he proposed to me on Skype and now we’ve had two months of relationship through Viber.

“Dad, I need your blessings, good wishes and a big wedding.”

Father: “Wow! Really? Then get married on Twitter, have fun on Tango, buy your kids on Amazon and pay through PayPal. And if you are fed up with your husband…sell him on eBay.