Well, I was going to start off this month’s letter with an economist joke…but there was no demand… Maybe something more sobering from our own late great San Diego weatherman John Coleman, “The point to remember is that what the government gives it must first take away.”

The COVID-19 virus has careened around the globe. The pandemic will recede, but it will leave behind an economic disaster. I would tell you that we can now see the tunnel at the end of the light! The Great Lock Down is now leading us to the Great Re-set. The idea that laying on the couch to save the world is not the solution. We must have goals, as a country, and as individuals. As a runner, I know that the first rule of training is to have a goal. Working toward a target race can give you a tangible objective, a sense of purpose, and help fight the inertia to stay on the couch instead of going out for a run. Having sustained injuries (sometimes even life-threatening ones), I realize that you do fall back but then you improve. You do so by setting small goals, rebuild habits and sometimes being more creative (I dictate notes to myself on runs, I wore a snorkel in a triathlon because of my fear of the water). Sometimes you need the doctor or chiropractor to get you fixed. Sometimes you need to change your diet. In all cases, just like our future in the coming months, we must Adapt, Innovate, and Overcome! #beproductive.

Since I wrote my letter last month, we have lost 300,000 jobs in San Diego County! We moved from 4.8% unemployment to 20.6%. Costar reports that 17% of deals scheduled to close in April were called off. In San Diego that amounted to about $24 million in deals. Sellers have delayed disposition plans 1-2 quarters. Lenders are slowed as they mitigate risks in their portfolios. Plus, how do you value something if you are uncertain about rent being paid? The question is who is paying rent and how much. Who is forgiving rent and how much? Who is making their loan payment and who is not?

The questions to be asked and monitored now are;

- The percentage of tenants paying rent. The percentage paying full or partial rent?

- Months of lost income forecast?

- How long before leasing market returns and what rates will be when it does?

- Renewal probabilities for tenants?

- Which tenants will open first?

- What percentage of tenants will not re-open?

At this point, we are recommending to landlords and tenants to “Blend and Extend” as the way to give help on rent forbearance and get a longer lease term.

The Commercial Real Estate recovery is going to trail the economic rebound (as it did in previous downturns). It will be an 18-30-month recovery, depending on the sector. Industrial and logistics will recover quickest -6 to 12 months, followed by multi-family in about 18 months, retail, food, and hotel face a longer recovery of up to 30 months.

Ten-year treasuries sit at about .6% today but I expect they will be about 1% by year-end and back near 2.5% in 2021 and continue to 3% by 2022 and 2023. CPI will follow a similar path starting at 1% this year and growing to 2.5% in 2021 and 3% in 2022. Keep this in mind when signing leases with fixed increases vs. CPI increases.

Nick recently attended a Costar webinar and will share some of what he learned below.

Nick’s Numbers

The Costar State of the Market webinar slide deck below comes to you thanks to Joshua Ohl, Managing Analyst at Costar, with additional data supplemented by Oxford Analytics.

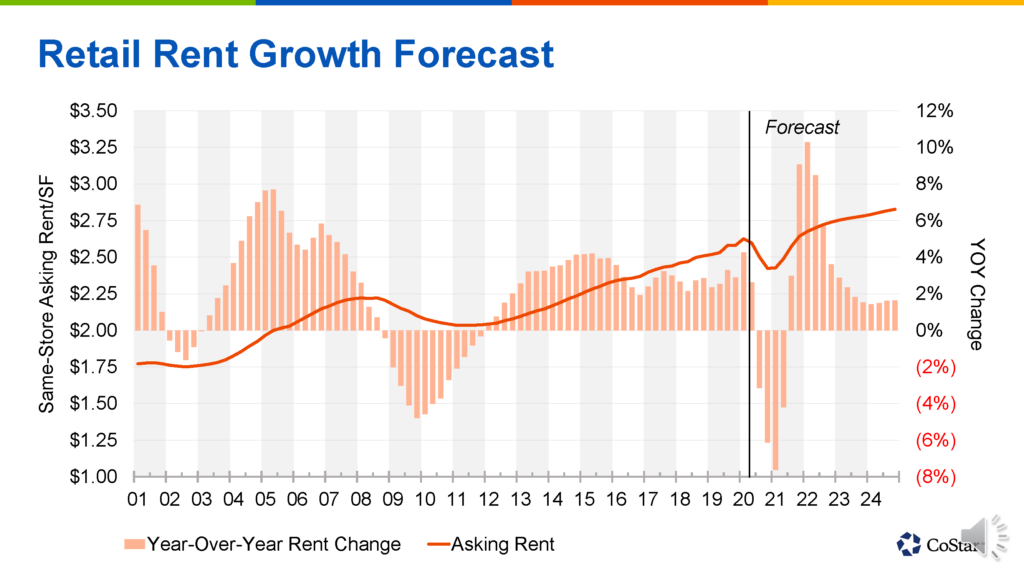

The most important takeaways from this webinar are rents are expected to fall across all asset classes for the remainder of 2020, leasing activity will be lower with new vacancies likely to rise, and investments are expected to slow as pricing/cap rates decline. These highlights are covered in greater detail on the slide deck below.

These somewhat obvious facts aside, it’s shocking to see how rapidly available data and the resulting models have been changing. The State of the Market webinar was presented over a 4-day period, and by the 4th presentation…Oxford Analytics had already supplemented NEW data.

LINK TO COSTAR PRESENTATION

Please give me a call or email me if you would like an analysis of your properties’ value or to discuss what you should be doing with regards to the Coronavirus pandemic and its impact on your business, tenants, or property (Nick Zech, 858-232-2100, nzech@cdccommercial.com).

The short term seems a bit bleak. It is a certainty that Coronavirus will change how we shop, travel, and work for years. Only one-quarter of CFO’s surveyed expect to return to the same level of office use. Telemedicine has blossomed. Online grocery shopping is up 100%. Online education has exploded (what if test scores go up?). Office electricity charges are down 25% but residential trash (and electricity) has exploded. Staples and Costco are out of office chairs countywide! Airplanes (when we start flying again) will be loaded from back to front (which I always thought was more efficient anyway). Expect more digital events. Expect e-sports to blossom (something is better than nothing).

Beyond the pent-up demand (I think barbers and beaches might be busy 24/7 when things open up), crises often produce above-average numbers of divorces, marriages, and births – all of which create demand for housing. I don’t know how soon people will want to flock to small overly dense urban housing. Maybe the new COVID generation may seek happiness in the suburbs (or further out) with the security of fast internet, a low-interest mortgage, the joy of a yard, and the cocoon of a self-driving car.

If you want some mid-month reading, look me up and connect on Linkedin. Later this month, I will be posting some interesting material on jobs lost vs lives lost and jobs lost vs shopping space loss and a bit of random information about the pianist turned politician Ignacy Jan Paderewski

In the month ahead while you are busy adapting, innovating, and overcoming, I hope that you also remember that success is failure turned inside out. The silver lining to the clouds of doubt. I also hope you enjoy the story…

Paderewski Concert

Wishing to encourage her young son’s progress on the piano, a mother took her boy to a Paderewski concert. After they were seated, the mother spotted an old friend in the audience and walked down the aisle to greet her.

Seizing the opportunity to explore the wonders of the concert hall, the little boy rose and eventually explored his way through a door marked “NO ADMITTANCE.”

When the house lights dimmed and the concert was about to begin, the mother returned to her seat and discovered that the child was missing.

Suddenly, the curtains parted, and spotlights focused on the impressive Steinway on stage. In horror, the mother saw her little boy was sitting at the keyboard, innocently picking out “Twinkle, Twinkle Little Star.”

At that moment, the great piano master made his entrance, quickly moved to the piano, and whispered in the boy’s ear, “Don’t quit. Keep playing.”

Then leaning over, Paderewski reached down with his left hand and began filling in a bass part. Soon his right arm reached around to the other side of the child, and he added a running obbligato.

Together, the old master and the young novice transformed a frightening situation into a wonderfully creative experience. The audience was so mesmerized that they couldn’t recall what else the great master played. Only the classic “Twinkle, Twinkle Little Star.”