“The early bird may get the worm, but the second mouse gets the cheese in the trap.”

The lower the interest rate, the easier it is to justify marginal projects toward the end of a business cycle when only cheap money gets the deal done. Thus, that is why commercial real estate tends to boom towards the end of the cycle and then drops into the abyss when interest rates rise and/or the economy contracts. Put another way, commercial real estate is the living embodiment of the adage that easy money makes you stupid.

With interest rates high, transactions have slowed, and it is making it difficult to know what things are worth. Over the next 5 years, more than $2.5 trillion in commercial real estate debt will mature and, in most cases, will have to be refinanced at higher rates ($700 billion in this year alone!). Higher rates will mean less cash flow and less cash flow will force cap rates higher. Higher cap rates mean lower property value and so it goes.

Real estate finance is not the only place feeling the finance squeeze. The subprime auto lending market is crashing as I write. Capital One has closed ALL credit lines for auto dealers. Wells Fargo has laid off all of its junior auto loan underwriters. The average loan-to-value (LTV) on a subprime loan was 150%. That means they were lending $20,199 on a $13,500 car! Average interest rate? 18%!

With higher interest rates come less loans, with less loans, thousands of mortgage employees have lost jobs and demand for space by the mortgage industry has plummeted. The square footage signed in the first quarter fell by 85% from the first quarter last year. To put this in further perspective, in the first quarter 2020 (pre-pandemic) 183 leases were signed, while in the first quarter this year we had only 17.

If you have a loan coming up in the next three years, you should consider talking to your lender now. Lenders are not looking for non-performing loans to start hitting their books in the coming years so many are willing to look at extending existing loans or doing a “blend and extend.” In the end it will boil down to loan-to-value and debt coverage ratios.

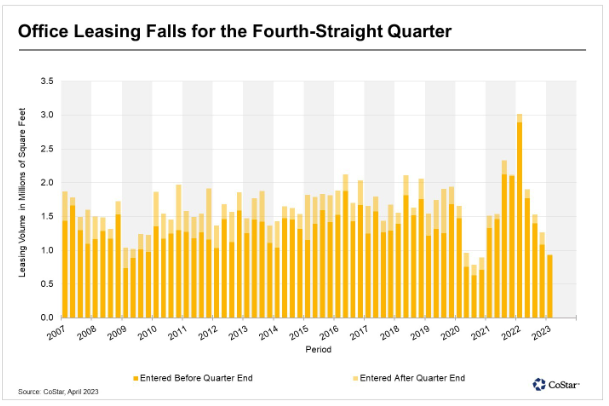

It’s not just mortgage companies that have slowed down leasing space. There’s been a notable retrenchment in office leasing activity since mid-2022 and the first quarter of 2023 continued the decline, making it the fourth straight of declining volume in the San Diego office market. The most notable drop has been biotech which has fallen 67% in the last year. A big part of the problem is work from home and tenants are squeezing more employees into less space. The ratio of space per worker has dropped roughly 20% over the last 10 years.

Nick’s Numbers

The chart below shows the precipitous drop Don talked about in office leasing.

If you would like an analysis of your properties’ value or discuss what you should be doing with regard to interest rates or inflation and their impacts on your business, tenants, or property, I’d be happy to talk. (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

A still tight labor market is clashing with employers who are demanding workers to return to the office. Workers are demanding more flexibility and autonomy, but they also want serendipitous social connections – those “water cooler moments.” A recent study by Stanford economist Nicholas Bloom noted that those who came into the office devoted about 40 more minutes a week to mentoring others, nearly 25 more to formal training and about 15 additional minutes doing professional development.

We live in an interesting time. I saw a recent survey done by the University of Chicago, funded by the Wall Street Journal. A whopping 80% felt the nation’s economy is poor or not so good. 85% thought the economy would get worse or stay the same. However, the same study reported that 62% were satisfied with their present financial condition. 66% said their financial situation is better or about where they expected to be at this time in life. 72% said the rising cost of living was of no concern or minor in nature.

Well, I don’t know who the 72% are that aren’t affected by increased cost of living, but it is certainly hitting commercial real estate. We recently received tenant improvement pricing guidelines from JACOR Construction. While replacing the old sheet from about two years ago I compared some of the numbers – WOW!

| WAS | NOW | |

| Demo of walls, ceilings, floors, etc. | $3.50 – $5.50 psf | $5.00 – $7.00 psf |

| Plastic laminate cabinets | $325 lf | $650 lf |

| Ceiling | $4.50 psf | $6.00 psf |

It may seem impossible to escape from negative thoughts right now. We’re surrounded by negativity everywhere we turn. Fortunately, research shows we can protect ourselves from the damaging effects of toxicity. However, there is a productive way to counter these effects. It’s called thriving – the psychological state in which people experience a sense of both vitality and learning. Thriving individuals are growing, developing, and energized rather than feeling stagnated or depleted. Thriving buffers us from distractions, stress, and negativity. How do you do it you ask?

- Avoid negativity – pay attention to what you are consuming (TV, social media, etc.).

- Watch what you say – think how you frame a situation. “This is the worst I’ve ever seen.” Can be reframed as, “This situation is challenging and an opportunity to learn and grow.”

- Adopt a neutral mindset – try to be non-judgmental. Try to have a nonreactive way to assess a problem or crisis.

- Practice gratitude – have an “attitude of gratitude” as you take on the challenge and get through it.

- Manage your energy – eat well, sleep well and exercise. If you can do any of them outside, with others or to music, all the better.

- Seek positive relationships – at CDC Commercial we like to say we are paid to be optimists and problem solvers.

I recently heard professional golfer Tony Finau say on the Netflix series, Full Swing, “A winner is a loser who didn’t quit.” I will tell you that it is time to “Thrive and Survive ‘til ’25.” Hope you enjoy the story…

The Plan

In the beginning was THE PLAN.

And then came the assumptions.

And the assumptions were without form.

And The Plan was completely without substance.

And darkness was upon the faces of the crew men.

And they spoke unto their crew leaders, saying:

“The Plan is a crock of shit, and it stinks.”

And the crew leaders went unto their foremen and said,

“It is a pail of dung, and none may abide the odor thereof.”

And the foremen went unto their supervisors and said unto them,

“It is a container of excrement, and it is very strong, such that none may abide by IT.”

And the supervisors went unto their division managers and said unto them,

“It is a vessel of fertilizer, and none may abide by its strength.”

And the division managers went unto the director and said,

“It contains that which aids plant growth and it is very strong.”

And the director went unto the city manager and said unto him,

“It promotes growth and is very powerful.”

And the city manager went unto the mayor and said unto him,

“This powerful new Plan will actively promote the growth and efficiency of the department and this area in particular.”

And the mayor looked upon The Plan and saw that it was good.

And The Plan became policy.

And this is how shit happens.