This creative tenant was delivered his lease in a Word document and decided to sneak in an extra clause. I am now considering adding this to all our future listings! Then I could look forward to cakes every August!

You may have read this month that Lynsi Snyder, the heir and president of the In-N-Out empire, announced her planned departure to Tennessee. While it is sad to see another rich person depart the Golden State, I am far more worried about the average fast-food worker. New data is out and since September 2023, when $20 per hour minimum wage was implemented, the state has lost 36,565 fast food jobs.

The saddest thing is that 90% of these jobs are workers under 35 and the largest subgroup being teenagers. As if that isn’t bad enough, Flippy the robot is now coming for all of their jobs. It’s capable of doing 100 baskets of fries an hour (now that sounds healthy huh?). It is already being deployed in Jack in the Box, White Castle and CaliBurger locations. Don’t worry, Chippy, Sippy and Drippy are right behind.

On the topic of restaurants, we are seeing sales down across the board. Yet, we are still seeing restaurant operators looking for new sites. Also, from Costco to local liquor stores, liquor sales are way down. Not sure yet if that is post-COVID or pro-health. We’ll see.

Speaking of pro-health, food and young people, did you know that 67% of calories consumed by children are from Ultra-Processed Food (UPFs)? AB1264 is intended to start rooting UPFs out of school meals by 2032. If you would like to make this happen, below is a link to contact your state senator.

Fight against harmful ultra-processed foods in California’s schools.

While on the subject of unemployment, San Diego’s unemployment rate surged by nearly a full percentage point, to 4.99% in June. The concern is the losses in higher paying jobs like professionals, business services, manufacturing and research and development.

Staying on health for a moment. As I grow another year older, I questioned why men die five years younger than women. Now I am all for equal rights, so I think we need to close the gap. I get it that men may live more dangerously. For instance, they’re 25% more likely to die in a solo car crash (maybe why one of my favorite bumper stickers is, “Hold my beer, I’m going to try something.”). But accidental death isn’t the only issue. Men are more likely to commit suicide. And they suffer worse outcomes than women across eight of the top 10 health issues including stroke, heart disease and liver disease. So, I’m not going to climb into a pulpit and extoll some fad diet or exercise, but broadly speaking:

- Visit the doctor regularly for a check-up and anytime something’s wrong.

- Exercise in some form every day.

- Prioritize sleep and stress management.

- Monitor your health with regular blook work (know your numbers!). You know, you can order your own blood work directly through Quest, Insider Tracker or Function Health?

The new One Big Beautiful Bill (OBBBA) is over 10,000 pages (now that’s streamlining government!), but here are the major takeaways around commercial real estate.

- They didn’t touch 1031 exchanges!

- They restored 100% bonus depreciation which includes full expensing of assets like HVAC.

- Enhanced QBI deduction (pass-through benefit). The QBI deduction is extended permanently and increased from 20% to 23% for pass-through entitles like LLCs.

- Expanding Section 179 expensing. Raises exporting limit to $2.5 million allowing immediate write-off of qualifying equipment improvements – significant for CRE property.

- Opportunity zones extended and enhanced.

- Interest deductibility loosened – EBITDA-based interest deductibility reinstated (rather than EBIT). More financing cost recovery on leverage CRE deals.

Despite all of these perks, balancing our budget is the only decisive principal that will enable genuine reform of government. The problem standing in the way is the American people and their politicians who have become drunk on federal dollars. But, a balanced budget leads to lower taxes, lower interest rates, a healthier economy and increased jobs and take-home pay. You can’t have your cake and eat it too (unless it is in your lease or listing!)

Nick’s Numbers

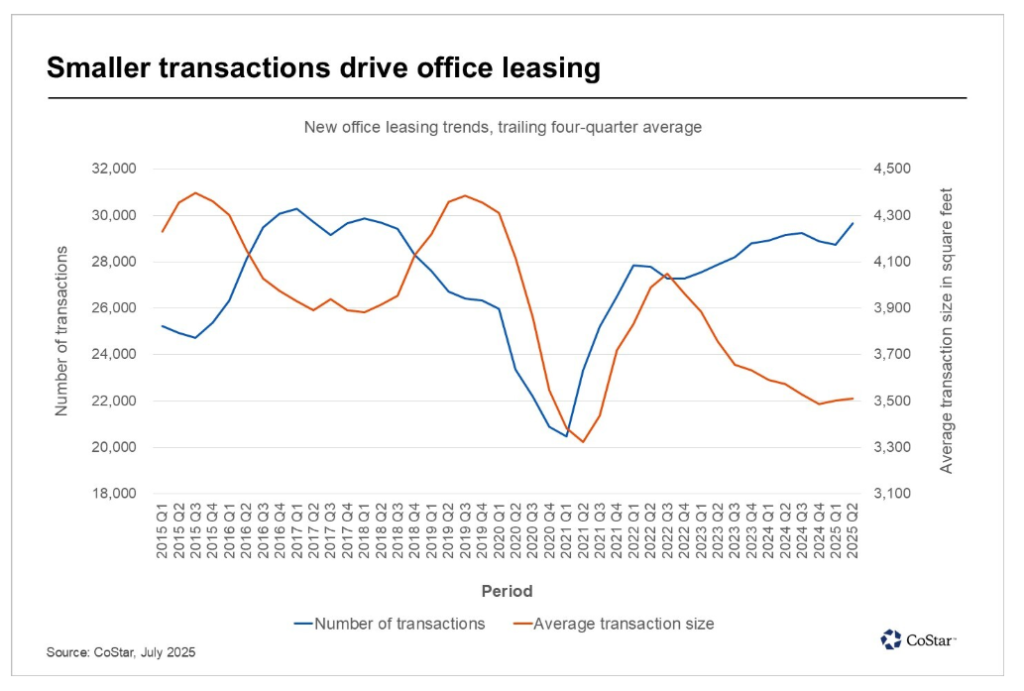

We are experiencing an interesting phenomenon in the office leasing market. With the lack of new office being built, large occupiers have fewer opportunities to upgrade to first-generation space. With less hiring, large tenants are staying in place, renewing existing leases and being patient. There may be opportunities in the future for redevelopment of older projects (because new construction is so far down the pike and new construction is so expensive.). Smaller tenants are capitalizing and filling remaining spaces as return-to-work policies continue to kick in. So, in short, we are seeing more transactions for smaller spaces. See the chart below.

If you would like an analysis of your properties’ value or discuss what you should be doing with regard to interest rates or inflation and their impacts on your business, tenants, or property, I’d be happy to talk. (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

With interest rates high and opportunities starting to show up, start thinking about interest only loans.

When evaluating loan options, most CRE owners fixate on rate. But today, the most powerful way to boost cash flow isn’t a low interest rate – it’s full-term interest-only.

A key metric to understand this shift is the loan constant – your annual debt service divided by your total loan amount. It reveals the true cost of capital, not just the rate on paper.

What’s changed:

Lenders are now offering full term interest-only options, resulting in loan constraints that often rival those from the low-rate years.

Example:

- Then: 4.25% rate on a 25-year amort → Loan Constant: 6.46%

- Now: 6.35% full-term interest-only → Loan Constant: 6.35%

Surprising? Many owners are seeing higher cash flow today than they did with lower-rate, amortizing loans.

Sure, you don’t have principal paydown, but that is a small component, and it gets smaller with the leverage of the loan and if inflation (appreciation) kicks in.

For Father’s Day, I read James Patterson’s The #1 Dad Book, and I thought his 17 ideas to be a better dad were worth sharing as this month’s story. And having seen grandbaby #7 come into the world last week, I know parenting is not a piece of cake. Hope you enjoy the story…

If just two, or three, or five of these ideas work for you – you’ll be a better dad, and that’s time well spent.

- Be consistently fair. Trust really is built on consistency. And trust is everything.

- Be a listener. Listen to your kids. Listen to your partner. Listen to yourself.

- Learn how to say I Was Wrong. Just in case it ever happens.

- Don’t be afraid to say, “I love you.” Say it now. Loud and proud.

- Be a hugger. Hey, give yourself a hug every once in a while.

- Tell your kids your story. Listen to theirs.

- Read to your kids. Let them see books in your house.

- Have your kids’ backs. One day, they’ll have yours.

- Teach your kids to be responsible for their actions. And to be kind. That’s the sweet spot – kindness.

- Learn the value of the firm no.

- Change the stinky diapers, get wet at bath time, sing the little darlings to sleep.

- Be an all-world role model for your kids.

- Don’t argue in front of the kids.

- Grow the fuck up. It’s time.

- Eat as a family. And eat healthy. Most of the time anyway.

- Be a better dad and you’ll be a better partner.

- Find other dads to talk it out with.