“Do not be intimidated by the political caste or by parasites who live off the state…if you make money, it’s because you offer a better product at a better price, thereby contributing to general well-being. Do not surrender to the advance of the state. The state is not the solution.” ~Javier Milei, Argentina President

While on the subject of government, last year was a good year for lobbyists in California! According to the Secretary of State, nearly $480 million of advocacy efforts poured into the state (or should we say politicians) coffers. Who were they and why?

1. Chevron $11.2 mil – stop a cap on gas profits.

2. Hawaiian Gardens Casino $9.1 mil – slow casino regulation.

3. Western States Petroleum $6.9 mil – stop windfall profit tax.

4. McDonald’s $5.7 mil – fighting $22/hr minimum wage hike.

Speaking of McDonald’s and minimum wage, 2024 saw the implementation of $20/hr for fast food workers along with guaranteed 3.5% annual increases. You know what, using my trusty HP-12C to calculate the compound interest, I come up with $39.80 an hour in 2044. Lest that seem a long time to you, 2004 and $5.15 per hour seems like only a blink in the rear-view mirror. To further infuriate you, imaging that Big Mac, fries and a drink today at about $12 becoming $25.

Let me tell you, inflation won’t die until the economy kills it! In political parlance that means, it will take a crisis. And at the moment, we seem to have a Goldilocks economy – not too hot and not too cold. January had a blowout jobs report. Wages also grew, as did real gross domestic product. Lastly exports grew.

With household spending accounting for about two-thirds of economic growth, we should really be worrying about how long the consumer can hold up.

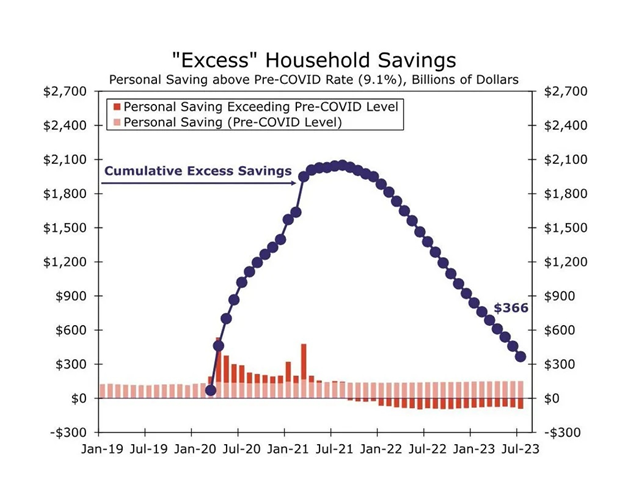

During the fourth quarter, 8.5% of credit card debt became delinquent 30 days or more and 6.3% moved into 90 days or later. For car loans, 7.6% became 30 days or later and 2.6% was 90 days. The last time these numbers were this high was 2010. The excess savings from the pandemic is mostly wound down. Consumers are turning to credit. Delinquencies are rising so it would seem it can only be a matter of time before spending will slow. With people and businesses already over-indebted, and rates staying high, it seems unlikely that more borrowing makes sense. Inflation remains sticky high, leaving no room for the Fed to cut. Instead, we may see a black swan where a “problem” becomes a “crisis.” In an election year, I can only expect politicians to try to take advantage. For those of us not willing to be intimidated by the politicians, stay the course and be alert for opportunities, they are starting to appear.

Lest you think you should run off and hide in a cave, income producing real estate has produced positive long-term unleveraged returns that have grown at 2.02 times the rate of inflation over the past 50 years. Real estate does follow economic cycles but over time has been a big winner. If you look at occupancy as a sign of market health, you will find that even in times of decreasing occupancy, returns were 140% higher than inflation.

Nick’s Numbers

Here is a chart that illustrates the wind-down of savings that is going on and why we expect it to affect consumer spending soon.

If you would like an analysis of your properties’ value or discuss what you should be doing with regard to interest rates or inflation and their impacts on your business, tenants, or property, I’d be happy to talk. (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

I hope you enjoy the month celebrating, whether it be more daylight (March 10th), St. Patrick’s Day (March 17th) or March Madness (basketball not the political melee). In the meantime, I hope you enjoy the story…

A young monk arrives at the monastery.

He is assigned to helping the other monks in copying the old canons and laws of the church by hand.

He notices, however, that all of the monks are copying from copies, not from the original manuscript.

So, the new monk goes to the head abbot to question this, pointing out that if someone made even a small error in the first copy, it would never be picked up!

In fact, that error would be continued in all of the subsequent copies.

The head monk, says, “We have been copying from the copies for centuries, but you make a good point, my son.”

The head monk goes down into the dark caves underneath the monastery where the original manuscripts are held. The archives, in a lock vault that hasn’t been opened for hundreds of years. Hours go by and nobody sees the old abbot.

So, the young monk gets worried and goes down to look for him.

He sees him banging his head against the wall and wailing.

“We missed the R! We missed the R! We missed the R! His forehead is all bloody and bruised and he is crying uncontrollably.

The young monk asks the old abbot, “What’s wrong, father?”

With a choking voice, the old abbot replies, “The word was…CELEBRATE!”