The Empire State Building in New York City played a prominent role in the movie Sleepless in Seattle with Meg Ryan (The queen of rom-coms When Harry Met Sally and You’ve Got Mail). This year on Valentines Day, more than 15 couples will take (or renew) their vows on the 80th floor of this famous real estate landmark. And if you love Meg Ryan, she has a new movie out streaming on Prime, What Happens Later.

Well, soft landings are the norm when we fly (sans the current 737 Max blip), but soft landings are rare in economics. Today’s growing calls for a soft landing are no guarantee. Since World War II, the U.S. economy has achieved just one soft landing (1995) across more than 10 tightening cycles by the Fed. The so-called soft landing – taming inflation, all while keeping the economy healthy – has renewed people’s fear of the future outlook (FOFO).

Economic uncertainty took its toll on top executives in 2023 as CEO departures topped 1,900, the highest leaving in over 20 years, according to the outplacement firm Challenger, Gray & Christmas. “Historically, we’ve seen large economic shifts preceded by a surge in CEO exits,” Senior VP Andrew Challenger said in a statement.

In the past year, leasing volume fell roughly 20% as firms increased their focus on getting workers back into the office, efficient use of office space and peak day attendance. This trend looks like it will continue through 2024. New leases are about 20% smaller compared to pre-pandemic levels according to CoStar data. Occupiers of space are figuring out how to do more with less space. Office vacancies sit at about 16.6%, which is the highest level in 20 years.

What is more fascinating is that office space is no longer being driven just by the number of employees. For decades, we could use a few simple rules of thumb like 150-350 SF per employee to get in the ballpark. Now, we have to understand the company’s culture, office policies and employee behaviors.

In a fairly recent positive turn of events, retail real estate is seeing a renaissance with in-person dining and shopping booming. National Shopping Center vacancy rates have fallen to 5.3% at the end of last year. Average asking rents are nearly 17% above pre-pandemic levels (2019).

Inflation continues to be a driving force behind many of the challenges businesses face today. Nowhere is this more apparent than in the restaurant business. I was watching Varney & Co. and saw how a restaurateur broke down his $16 BLT sandwich.

- Wholesale cost $5

- $20,000 a month on rent

- $6,000 a month on utilities

- $60,000 a month in labor

He goes on to say, “You figure in a 32% food cost. I have $11 of gross profit in that sandwich. You take all my costs and divide by $11 of gross profit and I have to sell 93,000 sandwiches to get to zero before I can make any money.”

Now, I look at it a little differently. Rent should be between 7% – 12% of gross sales, so I think he needs to have about $200,000 a month in sales or about 12,500 sandwiches a month to make things work. I recently experienced a new cost saver at a Carl’s Jr. last week. My order in the drive-thru was completely taken by an automated attendant (full voice recognition!) and 100% accurate the first time (which is better than my normal human attendant experience). The future is here, and it will be disinflationary, but at what cost?

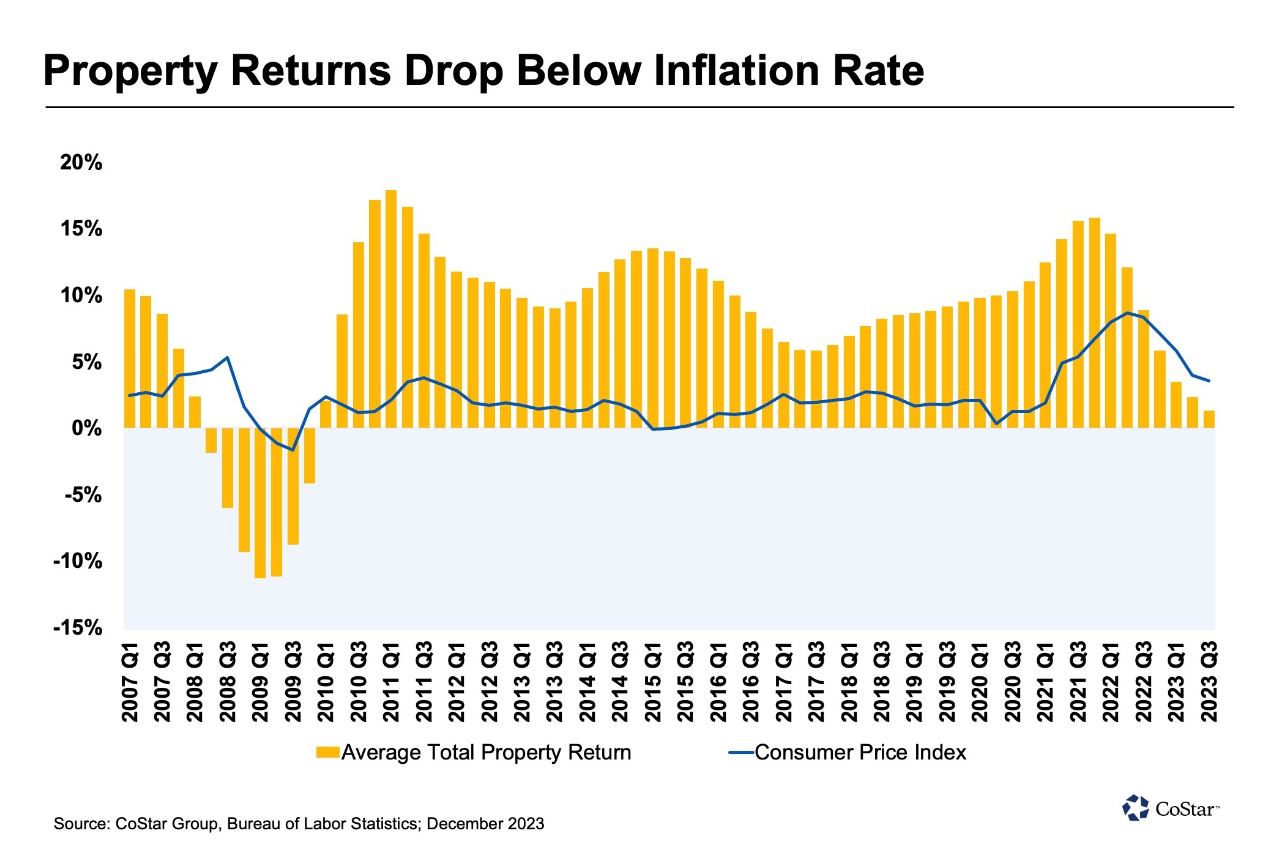

The Federal Reserve’s efforts to rein in inflation are starting to show up in the ability of real estate investors to make money. The sharp rise in interest rates has caused a fallout in property returns. Returns peaked in 2021 at 15.8% and have dropped to 1.3% in the 3rd quarter of 2023. Returns are now below the rate of inflation. The last time property returns sunk below inflation was during the Great Recession, and they didn’t climb back over CPI until two years later.

As you may know, I have questioned the accuracy of the reporting of both inflation and unemployment numbers for awhile now. I was encouraged to see Jeffrey Gundlach, the billionaire “Bond King” question unemployment numbers last week, “Amazingly, 88% of states are reporting rising unemployment over the last six months. How can it be that national unemployment stays at a very, very low level?” I don’t know myself, but if you like financial mysteries about cooking the government books (actually thrillers), you might like Stephen Frey’s book, The Insider.

Nick’s Numbers

The chart below illustrates Don’s point above of property returns dropping below CPI (inflation).

If you would like an analysis of your properties’ value or discuss what you should be doing with regard to interest rates or inflation and their impacts on your business, tenants, or property, I’d be happy to talk. (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

On a long enough timeline, the survival rate for everyone drops to zero. That is why I found a study about people’s deathbed regrets so interesting. The number one regret was not spending time with loved ones. The second was spending too much time at work and not with their families. Lastly, people regretted the lack of courage to pursue a life true to their passions, rather than living for other people’s expectations. Everyone dies, but not everyone lives well! Happy Valentine’s Day! I hope you find love and passion in your life, and you enjoy the story…

Armstrong’s Secret

In case you didn’t already know this little tidbit of trivia, it might make you chuckle when you read it.

On July 20, 1969, as commander of the Apollo 11 lunar module. Neil Armstrong was the first person to set foot on the Moon.

His first words after stepping on the Moon, “That’s one small step for man, one giant leap for mankind,” were televised to earth and heard by millions.

But just before he re-entered the lander, he made the enigmatic remark, “Good luck, Mr., Gorsky”,

Many people at NASA thought it was a casual remark concerning some rival Soviet cosmonaut.

However, upon checking, there was no Gorsky in either the Russian or American space programs.

Over the years, many people questioned Armstrong as to what the ‘Good luck, Mr. Gorsky’ statement meant, but Armstrong always just smiled.

On July 5, 1995, in Tampa Bay, Florida while answering questions following a speech, a reporter brought up the 26-year-old question to Armstrong. This time he finally responded.

Mr. Gorsky had died, so Neil Armstrong felt he could now answer the question.

In 1938, when he was a kid in a small Midwestern town, he was playing baseball with a friend in the backyard.

His friend hit the ball, which landed in his neighbor’s yard by their bedroom window.

His neighbors were Mr. And Mrs. Gorsky.

As he leaned down to pick up the ball, young Armstrong heard Mrs. Gorsky shouting at Mr., Gorsky, “Sex! You want sex! You’ll get sex when the kid next door walks on the Moon!”