Wow! Did no one else notice… or care that Fitch Ratings downgraded the U.S.A.’s long-term foreign currency default rating from AAA to AA+? Their reason? Erosion of governance. Rising general government deficits. Debt to GDP. The economy slipping into recession. Fed tightening. Need I say more?

So, I am thinking of being a kid when you blew up a firecracker. You touched the match to the fuse and ran like hell and turned around just in time to watch it go bang!

Then it happened…the fuse lit, ran away, turned back…no bang. Now what? Scared to death, you creep back. Nobody wants to pick it up (after all this is why your parents told you about blowing your fingers off!). Well, this is the “minefield” I feel we are wading in right now. Well known economic indicators like consumer debt, money supply, excess savings and an inverted yield curve have been pointing an ominous picture for a while now, yet no explosion.

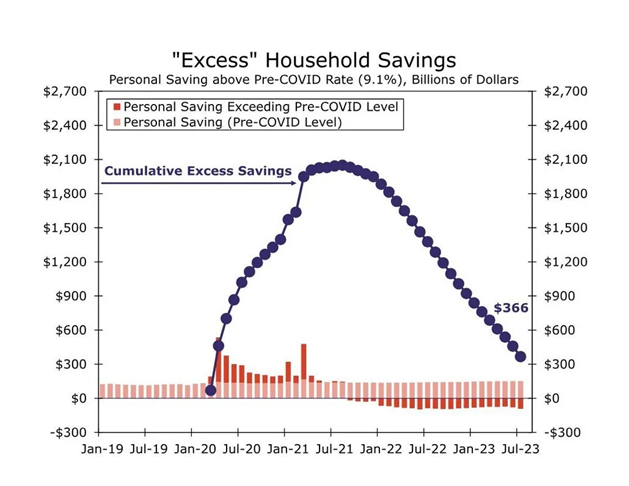

When the pandemic hit, people hit the brakes, stopped spending, and received windfalls of stimulus money. Economists called the amount of cash that built up “excess household savings.” The cash cushion is why consumer spending and economic growth have exceeded expectations so far in 2023. But now it’s almost gone. Excess savings have fallen for 23 straight months, as tapped-out consumers continue to live beyond their paychecks. There’s less than $300 billion left, and that will evaporate in another couple of months – just in time for student loan payments to begin again!

One thing that has kept many Americans afloat these past few years is that student loan payments were suspended. Yet people are still using credit cards to cover day-to-day expenses. Total credit card debt surpassed $1 trillion for the first time in history, while the average rate has risen to 20%. People now have 20% of interest payments on balances they can’t afford to pay off! Add to that – student loan balances that haven’t been paid on since 2020 but will start again in October. Match…fuse…

Nick’s Numbers

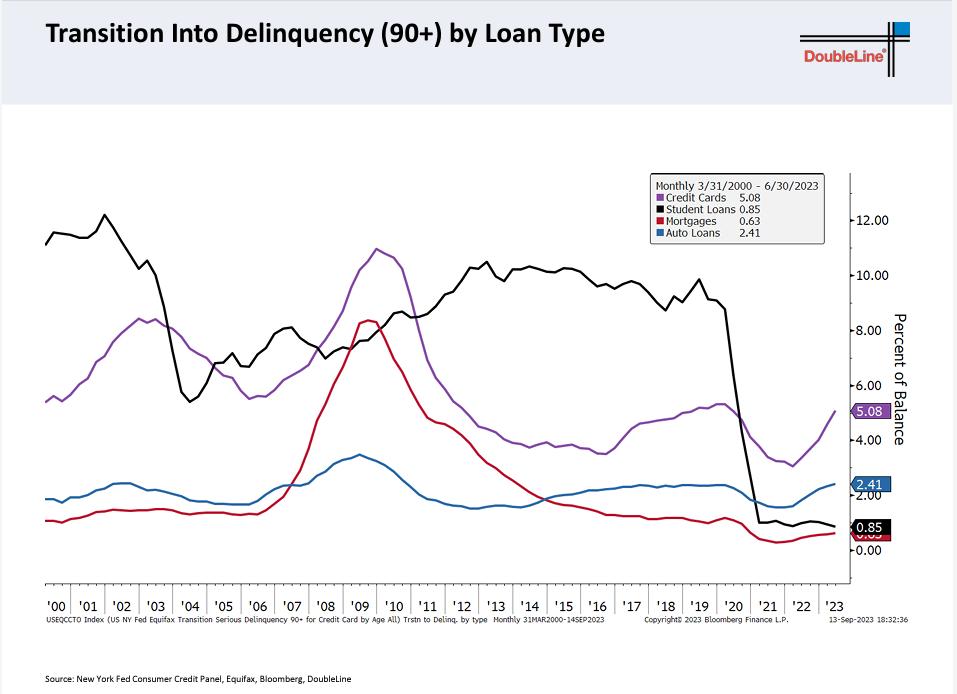

Below, I have two charts that illustrate the points that Don is making. First is a graph showing all the types of credit that are turning up 90+ days delinquent (except student loans, which we assume will turn up as soon as they start needing to be paid in October). The second chart shows Excess Household Savings running out soon.

If you would like an analysis of your properties’ value or discuss what you should be doing with regard to interest rates or inflation and their impacts on your business, tenants, or property, I’d be happy to talk. (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

“Fuzzy Math” was first introduced to the public by George W. Bush during the 2000 televised presidential debates. “This man has been disparaging my plan with all this Washington fuzzy math.” Since then, these terms have been frequently used by politicians and others to suggest that their opponent’s numbers are doubtful or are otherwise inaccurate.

How does “Fuzzy Math” relate to real estate ownership? Sometimes deceptive calculations can result in wide differences in financial outcomes, tax considerations and the ultimate disposition of real estate.

Here are three definitions of rents:

Current Rent: What you’re collecting now.

Economic Rent: What the market says you should receive in rent

.

Proforma Rent: What a seller will represent to a buyer that they should be able to get.

- Current Rents: The current rent, also referred to as contract rents, relates to the income generated by the existing owner. These current/contract rents may vary based upon owner’s management skills or involvement, property condition, existing leases, and overall economic conditions.

- Economic Rents: Otherwise known as market rents, are estimated based upon comparable properties in the unique marketplace. This involves compiling current information by property managers or appraisers, considering comparable rental units, and adjusting for quality, location, amenities, and condition of the overall property in a unique market. This is sometimes referred to as “What will the market bear?”

- Proforma Rents: Sometimes called projected rents or potential gross income. A proforma rent calculation should be the same as “economic rent or projected rent.” Proforma rents are used interchangeably by owners, brokers, appraisers, and lenders. “Projected rents” is a term used to denote what a prospective new owner or new property manager may collect upon taking over ownership or management of the property. In some cases, these projected amounts are based on property upgrades, rehabilitation, and possibly more intensive management of the asset. There may be significant variations in the estimation of expected future possible rents.

The property owner’s goal is to maximize actual net operating income, which begins with maximizing rent collected. Gross scheduled income, less vacancy, less expenses equal net operating income.

When a property owner does their tax returns at the end of the year, they are interested in minimizing the income but maximizing the expenses to reduce the federal and state tax burden.

When a property owner loses interest in, or mismanages the property, the rents will go down, primarily because of vacancy and diminished condition of the property.

When an owner approaches a lender for financing, the owner gets interested in maximizing the rents, so that the property will appraise for more, hence a larger loan amount.

When the property owner passes away, their estate planners and attorneys work ferociously to attempt to lower estate taxes. This may involve showing lower rents and significantly poorer property condition for tax purposes.

If the economy remains strong, the population grows, and there’s a solid demand for rentals, actual rents will eventually rise to the level of proforma rents.

If the economy doesn’t continue to boom, or worse, goes into the tank, unemployment rises, vacancies rise, and rental amounts collapse, then those proforma rents were simply someone’s optimistic illusion.

Interest rates are undoubtedly important to the economy and property valuations. But we also can’t control them or lose sight of the bigger picture. Mortgage rates were 18% in 1981 (in 1983, I bought my first house) for 20 years after that, rates averaged 7% to 8.5%. Everything worked fine, and lots of people made money. Sometimes you just have to be creative with your workarounds…and keep all of your fingers! Hope you enjoy the story…

This old lady handed her bank card to the teller and said, “I would like to withdraw $10.” The teller told her, “For withdrawals less than $100, please use the ATM.”

The old lady wanted to know why… The teller returned her bank card and irritably told her, “These are the rules, please leave if there is no further matter. There is a line of customers behind you”.

The old lady remained silent for a few seconds and handed her card back to the teller and said, “Please help me withdraw all the money I have.” The teller was astonished when she checked the account balance. She nodded her head, leaned down and respectfully told her, “You have $300,000 in your account, but the bank doesn’t have that much cash currently. Could you make an appointment and come back again tomorrow?”

The old lady then asked how much she could withdraw immediately. The teller told her any amount up to $3,000. “Well, please let me have $3,000 now.” The teller kindly handed $3,000, very friendly and with a smile to her.

The old lady put $10 in her purse and asked the teller to deposit $2990 back into her account.

The moral of this story is….

Don’t be difficult with old people; they spent a lifetime honing their skill.