What disease did cured ham actually have?

This month I have a lot of random observations. I usually have a topic or two or a theme, but like the rest of the world, I am trying to make sense of all of these disjunctive observations.

I just completed Walter Isaacson’s biography of Elon Musk. I highly recommend it for a holiday read. My favorite observation was when he was 18 and left home, his father told him, “You’ll be back! You’ll never be successful.”

Talk about a guy who is changing the world by “making stuff!” Capitalism is the system in which private ownership allocates the resources and labor used to produce goods and services. Markets need producers in order to stay visible. We need people who make things, grow things, fix things and teach things. It can’t just be trading things. We have to add value to the markets by creating useful items and services. Harry Moser, the founder of the Reshoring Initiative, outlines four ways to do this today.

- We need to expand our manufacturing work force by 40% and lower manufacturing costs. That’s 250,000 added jobs a year for 20 years. How? Fewer subsidized liberal arts degrees and more engineering degrees and certified apprenticeships.

- Lower the dollar exchange rate (25% – 30%). We are the reserve currency of the world (but maybe not as Brazil, Russia, India, China & South Africa plus Iran work to create a new gold-backed currency). Unfortunately, this makes the U.S. a great location for banking and a poor location for manufacturing.

- Our corporate tax rate needs to move down from 21% to 15%, which is more in line with the rest of the world.

- Reduce the cost of health care and end the practice of employer-provided, tax-free healthcare tort reform and getting a handle on medical litigation is a start. Getting healthcare costs out of the manufacturing burden will also help. The U.S. employer share of healthcare costs is about the same per employee hour as Chinese salaries.

The U.S. Gross Domestic Product (GDP) – which represents the value of all goods and services produced in the United States is currently rising by $61 million per day. The U.S. National Debt is currently $33.5 trillion and it’s currently rising by one billion per day. Therefore, U.S. Debt is rising 16x faster than the U.S. economy is growing.

People don’t have a strong intuitive sense of how much bigger 1 billion is than 1 million.

1 million seconds is 11 days.

1 billion seconds is 31.5 years.

The rapid collapse of First Republic, Silicon Valley and Signature Banks were the second, third and fourth largest bank failures in history (only behind Washington Mutual). The Fed came to the rescue by creating the Bank Term Funding Program (BTFP). Basically, the Fed allows banks to pledge their treasure bonds at face value, even though they are only worth 75 cents on the dollar. This is another form of quantitative easing at the same time the Fed is raising rates – quantitative tightening! Although the Fed may realize that loaning on assets that have to go up 33% to break even is inflationary (even fraudulent if you or I were to do it – isn’t that what Trump’s trial is about?), they also realize closing the lending facility will reignite the crisis. The program ends in March – stay tuned.

For another government program that might help you, a restaurant tenant of yours or just your favorite bistro, SDGE is providing $5,000 grants to small restaurants (<$3 million is annual revenues). Apply at: www.restaurantscare.org/resilience.

Retail sales grew better than expected in September despite having less cash in the bank and more credit card debt (average household credit card debt is $7,300) consumers increased their real spending, largely in experiential locations (food & drinking places +9.2% year over year). Health and personal care up 8.3% and auto dealers up 6.3%.

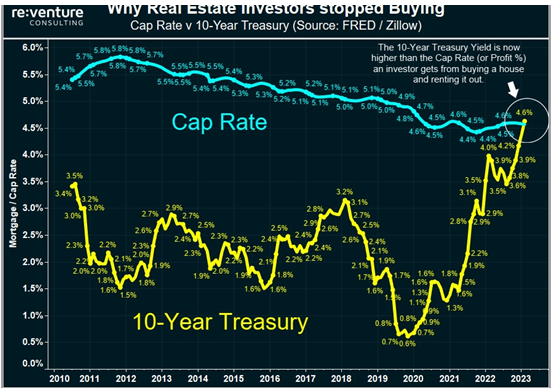

Finally, as illustrated in Nick’s Numbers below, you will see very clearly why the CRE market is slowing. If you can get the same return on Treasuries as you can on your real estate investment, why would you invest? The answer is clear. 10-year treasury must come down about 2% points or CAP rates need to rise about 2% points (like 7% plus cap rates) or sellers need to be able to carry back financing around 3%. Seller financing can also help the seller. Depending on your specific situation and tax laws of your state, you may be able to spread the capital gains taxes over the life of the contract rather than paying it all at once.

Nick’s Numbers

Below you will see that the return on Treasuries are equaling or exceeding cap rates.

If you would like an analysis of your properties’ value or discuss what you should be doing with regard to interest rates or inflation and their impacts on your business, tenants, or property, I’d be happy to talk. (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

Whether you’re a billionaire or an apprentice learning a trade, this is the month that we gather to be thankful for all that we have and the opportunities this great nation affords us. We’re ever so thankful for all of you, our clients and friends. No one knows which way the winds might blow us. I only hope you enjoy this Thanksgiving Forecast as much as you do your turkey, family and friends!

THANKSGIVING FORECAST

Turkeys will thaw in the morning, then warm in the oven to an afternoon high near 190F. The kitchen will turn hot and humid, and if you don’t bother the cook, be ready for a severe squall or cold shoulder.

During the late afternoon and evening, the cold front of a knife will slice through the turkey, causing an accumulation of one to two inches on plates.

Mashed potatoes will drift across one side, while cranberry sauce creates slippery spots on the other. Please pass the gravy.

A weight watch and indigestion warning have been issued for the entire area, with increased stuffiness around the beltway. During the evening, the turkey will diminish and taper off to leftovers, dropping to a low of 54F in the refrigerator.

Looking ahead to Friday and Saturday, high pressure to eat sandwiches will be established. Flurries of leftovers can be expected both days, with a 50 percent chance of scattered soup late in the day. We expect a warming trend where soup develops. By early next week, eating pressure will be low as the only wish left will be the bone.