The economic slowdown is now underway and inflation rates, though moderating, are still too high. The monetary policy trilemma (is that even a word?) of price stability vs financial market stability vs economic support is now a reality. The Fed just increased interest rates another ¼ percent and bank regulators just released a proposal to require banks to increase the capital they hold in reserve. On a positive front, the U.S. economy grew last quarter by 2.4% (1.5% was expectation). Consumer confidence improved in July to 72.6 from 64.4 in June and 51.5 last July. Yet, consumer spending was down with consumers being more conservative of how and where they spend their money. A case in point, new car sales in San Diego are up 5.4% for the first 6 months of the year and expected to be up 8.9% for the year according to the New Car Dealers Association of San Diego. However, keep your eye on consumer spending (70% of our economy!). Recessions are brought on by sharp slowing of consumer spending.

A slow-motion crisis is unfolding in the commercial real estate market, thanks to the double whammy of higher interest rates and lower demand for office space since the pandemic.

The U.S. office market has almost 1 billion square feet of vacant office space. If stacked together, it would span over 48,000 floors. This tower of empty office space would reach all the way to the International Space Station according to the visual capitalist. This growing vacancy rate is leading to 5-10 office towers a month going into risk of defaulting, according to Trepp. These vacancies and ensuing defaults are leading to a mark-to-market situation that CBRE Group estimates could lead to a 30% devaluation of office buildings this year.

As if that is not enough, banks and capital markets have frozen. On the one hand, without these properties trading, banks are struggling to know where pricing value is. On the other hand, many banks face the same issue as Silicon Valley Bank (SVB). They hold a bunch of low interest treasuries (like 1%) which are now underwater, effectively putting the banks underwater. However, the Fed, through all kinds of machinations, has stepped in and backstopped the banks by loaning them short-term money until they can get above the water line again. However, with this one-two punch, banks aren’t lining up to make loans and at these higher rates, borrowers aren’t as interested either. In a previous cycle, I remember them being called “bikini loans,” as in you can look but not touch.

In San Diego, we are faring a little better, but unemployment has ticked up from April’s 3.3% and now resides at 3.5%. However, prices have jumped 5.2% in the last year, giving San Diego the second highest inflation rate in the nation. Office vacancies have continued to increase but sublet space is the story as tenants try to find their “right size” in this hybrid world. At the end of the second quarter, San Diego had 3.1 million square feet of sublet space available. That is 1 million square feet more than was available last year.

Nick’s Numbers

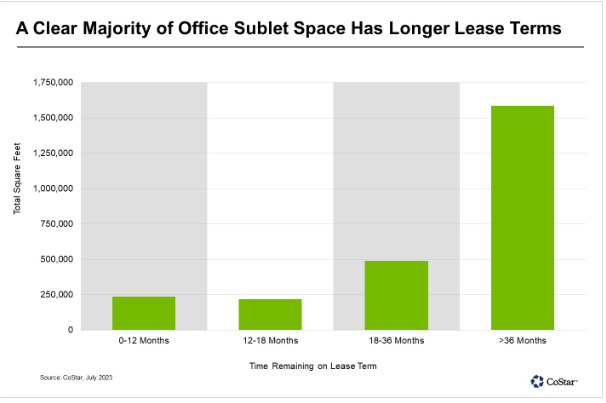

Below is a chart showing the increasing amount of long-term sublet space being offered on the market. This shows that companies are downsizing because of the economy and/or adjusting to a hybrid work force.

If you would like an analysis of your properties’ value or discuss what you should be doing with regard to interest rates or inflation and their impacts on your business, tenants, or property, I’d be happy to talk. (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

As mentioned earlier, we haven’t seen enough events to demand that the market revalue and “mark-to-market,” so in the meantime the king will continue to have no clothes. The next logical question is, “how far will prices fall and when will they bottom out and recover?” (Wouldn’t we all like to know!) First let me tell you, I got COVID wrong. I thought housing prices would plumet! Back to rule #1 – don’t bet against the Fed. And right now, the Fed is telling banks with qualified borrowers on existing loans with quality assets to work with them and extend for 18-24 months, so basically, “pretend and extend.” What we do know is the CRE prices have declined for two quarters and in previous declines it has taken two years for prices to begin to recover. However, in the past, the declines were not preceded by a global pandemic that changed the way we live, work, and use space.

In the real estate business, we are usually in the business of helping people make money, but I just had to pass on some critical info on not losing money. In 2022, Americans lost more money to investment fraud than any other type. According to the FTC, $3.82 billion was stolen in 2022, a 128% increase from 2021! California once again led the nation with a total loss of $870 million. On the coattails of this study, I received an email from the Department of Real Estate (DRE) warning of a sharp rise in real estate fraud, especially involving vacant land and unencumbered properties (i.e., no loans).

In the scheme, the criminal:

- Searches public records to:

- Identify properties that are free of mortgage or other liens.

- Identify the property owner – This often includes vacant lots, long-term rentals, or vacation rentals, with targeted properties often owned by the elderly and/or foreigners.

- Poses as the property owner and contacts a real estate agent to list the property for sale.

- Requests that the property be listed below market value to generate immediate interest.

- Requests that no “For Sale” sign be posted on the property.

- Requests preference for a cash buyer, quickly accepts an offer, and demands quick closing.

- Refuses to meet in person, preferring to be contacted through email, text, or over phone, and typically refusing video calls.

- Refuses to attend the signing and claims to be out of state or country.

- Demands to use their own notary, who then provides falsified documents to the title company or closing attorney.

- Insists that proceeds are wired to them.

So, in these trying times how are we making it work at CDC Commercial? I say, creativity. In the book, The Black Swan: The Impact of the Highly Improbable, the author talks about us entering an era of creativity. So, although AI can give you many answers quickly, it still can’t think outside the box. When I look back at some of the creative deals we have done, even I am shake my head in wonder. Over the years we have sold a department store to a museum and years later sold the museum to a college. We’ve sold hotels to homeless shelters and retail centers to churches.

We’ve taken auto repair shops and turned them into carpet sales and later to a massage therapy school . We’ve leased and sold lots of properties for clients. We have also done plenty of 1031 exchanges to find clients an appropriate tax free exchange in the very tight time qualifying time-lines (45 days to ID and 180 days to close). Including one this month for a client that wants to occupy the building for their own use years from now when the tenant vacates (in the meantime enjoy the income). We try to look at things differently – what’s the intrinsic land value? Can it be rehabbed, repurposed? Can the seller defer gains with a carry back loan and help the buyer with a lower than market interest rate?

Just know that we’re laser focused on the tasks at hand but trying to be creative in our solution, while not missing the forest for the trees. Hope you enjoy the story…

The Black Dot

One day a professor entered the classroom and asked his students to prepare for a surprise test. They waited anxiously at their desks for the test to begin. The professor walked around the class and handed the papers out with the text facing downwards.

Once he handed them all out, he asked his students to turn the page and begin. To everyone’s surprise, there were no questions, but just a black dot in the center of the page. The professor thoroughly read through everyone’s bewildered expressions and said, “I want you to write what you see there.”

The perplexed students began to do what they had been asked to do.

At the end of the class, the professor took all the papers and started reading each one of them aloud in front of all the students. All of them, with no exceptions, described the black dot, trying to explain its position in the middle of the sheet, etc. After all had been read, the classroom sat silent and the professor began to explain:

“I am not going to grade you on this test; I just wanted to give you something to think about. No one wrote about the white part of the paper. Everyone focused on the black dot – and the same happens in our lives. This is exactly what we end up doing with our lives. We have a white paper to hold onto and enjoy, but we are so busy contemplating about the dark spots that are in there. Life is a special gift, and we will always have reasons to celebrate. It is changing and renewing every day- our friends, jobs, livelihood, love, family, the miracles we see every day.”

And yet we insist on focusing only on the dark spots – the health issues that are bothering us, the money that we need to have, the luxuries we don’t have, the complications in any relationship, problems with a family member, the disappointment with a friend and so on.

You need to realize that the dark spots are very small and only few. And yet we allow these to pollute our minds.

Take your eyes away from the black spots in your life. Enjoy each one of your blessings, each moment that life gives you.

Be happy and live life positively!