“The line separating investment and speculation, which is never bright and clear, becomes blurred still further when most market participants have recently enjoyed triumphs. Nothing sedates rationality like large doses of effortless money. After a heady experience of that kind, normally sensible people drift into behavior akin to that of Cinderella at the ball. They know that overstaying the festivities, that is, continuing to speculate in companies that have gigantic valuations relative to the cash they are likely to generate in the future, will eventually bring on pumpkins and mice. But they nevertheless hate to miss a single minute of what is one helluva party. Therefore, the giddy participants all plan to leave just seconds before midnight. There’s a problem, though: They are dancing in a room in which the clocks have no hands.” – Warren Buffett

Our current market has led many long-term property owners to rethink their investment strategies. Sales falling while prices are reasonably stable is actually normal for real estate market tops. Sellers demand the prices they saw a year ago and buyers can’t afford to pay that much, so the number of people who have to sell for whatever reason starts to rise and the inventory increases. The resulting oversupply causes prices to drop and bubbles burst. That’s how it always works and the prospect only seems extreme because it’s been so long since the last time.

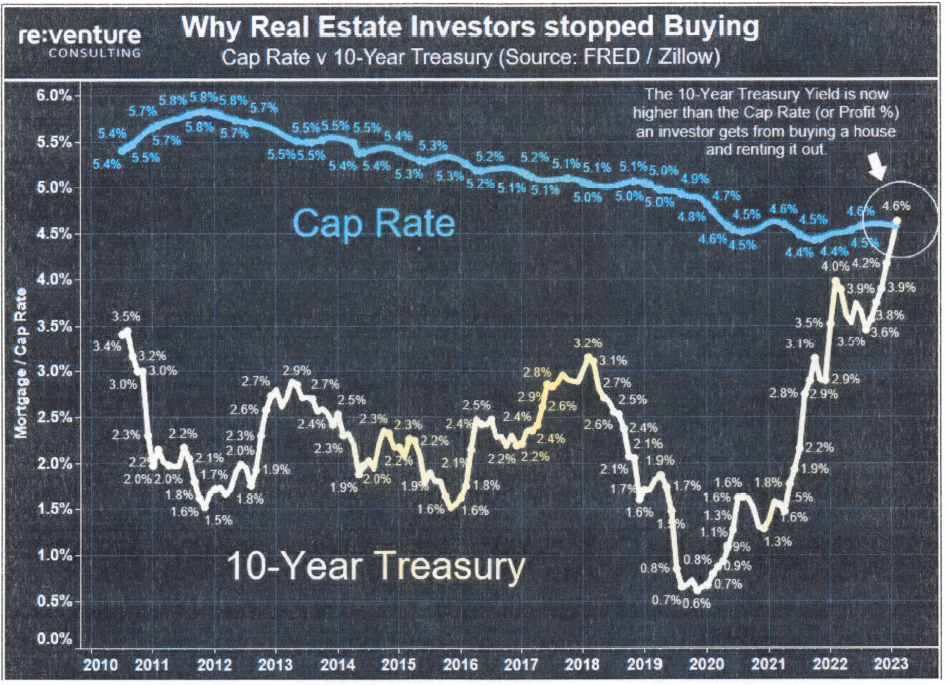

Here is a simple concept that is only just now starting to play out. Cap rates indicate the annual yield an investor might expect from a property if it were purchased entirely with cash (i.e., a million-dollar property at a 5% cap produces $50,000 a year in net income). However, cap rates are inversely related to the property price (cap rates rise, prices go down) and cap rates have not risen much in the last year. However, 10-year treasuries (and correspondently CDs) yields have skyrocketed. So why buy real estate when the same return, or better, is available risk-free? Sellers, brokers and buyers are all standing around thinking rates will drop and it will be business as usual…but what if they don’t? When will cap rates have to go up?

The NNN property sector (McDonald’s, Taco Bell, KFC freestanding triple net properties) is a unique niche in that most trades are less than $5 million, many buyers are mom and pop and for the most part, investors pay all cash. All are looking for low-risk, bond-like income and the ability to shelter income and tax deferral (IRS-1031) on sale. Because of this tax focus, U.S. treasury rates have a lot less impact on buyer and seller motivation. Despite that, the triple net sector is seeing a slowdown in transaction volume and when that happens there is a ripple effect because most NNN sellers turnaround and become buyers via tax-deferred exchanges. Expect 2024 to continue to see a slowing sales velocity, leading to rising cap rates (and lower prices). Between 2006 and 2010, during the Great Recession, cap rates for NNN deals under $5 million rose by about 1.75% percentage points. Thus far, we have only seen about a .5%, so I will go out on a limb and say we have a 1% to 1.25% hike still to go. Remember that a $1 million property at a 5% cap, originally, with a 1.5% to 1.75% cap increase (now a 6.5 to 6.75% cap rate), makes it worth $800K to $833K!

Nick’s Numbers

Interest rates have gone up an amazing 11 times since March of 2022. Treasury yields have followed. Cap rates are sticky and have not adjusted yet. The chart below gives some historical insight to this.

If you would like an analysis of your properties’ value or discuss what you should be doing with regard to interest rates or inflation and their impacts on your business, tenants, or property, I’d be happy to talk. (Nick Zech, 858-232-2100, nzech@cdccommerical.com).

According to a 2009 study conducted by the University of Sussex, just six minutes of reading for pleasure can reduce a person’s anxiety by two-thirds. I don’t have any books to recommend this month, but I do have two things that have reduced my anxiety that you might like. First, my kids have been giving me audible for the last couple of years and I just can’t rave enough – I listen when I drive, I listen when I run, I finish more books by the ton! Amazon Audible Membership Link

Also, a great stand-alone scanner is not cheap, but is a life changer (no cheap 3-in-1 or flatbed or scanner app on your phone). I can scan sheets of paper two-sided into a PDF in seconds. Everything is filed in folders (A-Z just like a file cabinet). Yes, I right clicked and created a folder “A” and then a folder “B” all of the way to “Z”. I’ve been doing it for years, but it gave me anxiety to see some clients doing a page at a time or going to the UPS store and shoving things into random folders. It’s like the difference between a flip phone and an iPhone. I use the Fujitsu – ScanSnap and it’s worth every penny!

Well, 2024 is certainly set up to be an exciting year. What with election havoc, markets tight as a violin string, we can expect all kinds of black swans and fireworks. But in the end, if you plant honesty, you will reap trust. We are here for you, and we hope you enjoy the story…

A successful businessman was growing old and knew it was time to choose a successor to take over the business.

Instead of choosing one of his directors or his children, he decided to do something different. He called all the young executives in his company together.

He said, “It is time for me to step down and choose the next CEO. I have decided to choose one of you.”

The young executives were shocked, but the boss continued. “I am going to give each one of you a seed today – one very special seed. I want you to plant the seed, water it, and come back here one year from today with what you have grown from the seed I have given you. I will then judge the plants that you bring, and the one I choose will be the next CEO.”

One man, named Jim, was there that day and he, like the others, received a seed. He went home and excitedly told his wife the story. She helped him get a pot, soil and compost and he planted the seed. Every day, he would water it and watch to see if it had grown.

After about three weeks, some of the other executives began to talk about their seeds and the plants that were beginning to grow.

Jim kept checking his seed, but nothing ever grew. Three weeks, four weeks, five weeks went by, still nothing. By now, others were talking about their plants, but Jim didn’t have a plant and he felt like a failure.

Six months went by – still nothing in Jim’s pot. He just knew he had killed his seed. Everyone else had trees and tall plants, but he had nothing. Jim didn’t say anything to his colleagues, however, he just kept watering and fertilizing the soil – he so wanted the seed to grow.

A year finally went by and all the young executives of the company brought their plants to the CEO for inspection. Jim told his wife that he wasn’t going to take an empty pot. But she asked him to be honest about what happened. Jim felt sick to his stomach. It was going to be the most embarrassing moment of his life, but he knew his wife was right. He took his empty pot to the board room. When Jim arrived, he was amazed at the variety of plants grown by the other executives. They were beautiful – in all shapes and sizes. Jim put his empty pot on the floor and many of his colleagues laughed, a few felt sorry for him!

When the CEO arrived, he surveyed the room and greeted his young executives. Jim just tried to hide in the back. “My, what great plants, trees and flowers you have grown,” said the CEO. “Today one of you will be appointed the next CEO!”

All of a sudden, the CEO spotted Jim at the back of the room with his empty pot. He ordered the Financial Director to bring him to the front. Jim was terrified. He thought, “The CEO knows I’m a failure! Maybe he will have me fired!”

When Jim got to the front, the CEO asked him what had happened to his seed – Jim told him the story. The CEO asked everyone to sit down except Jim. He looked at Jim, and then announced to the young executives, “Behold your next Chief Executive Officer! His name is Jim.”

Jim couldn’t believe it. Jim couldn’t even grow his seed. “How could he be the new CEO?” the others said. Then the CEO said, “One year ago today, I gave everyone in this room a seed. I told you to take the seed, plant it, water it, and bring it back to me today. But I gave you all boiled seeds: they were dead – it was not possible for them to grow.

All of you, except Jim, have brought me trees and plants and flowers. When you found that the seed would not grow, you substituted another seed for the one I gave you. Jim was the only one with the courage and honesty to bring me a pot with my seed in it. Therefore, he is the one who will be the new Chief Executive Officer!”